Longevity and its impact on pension plans focus of international conference

As our population ages and lives longer, employers may face challenges meeting their pension promises to employees.

As our population ages and lives longer, employers may face challenges meeting their pension promises to employees.

By Media RelationsWaterloo, Ont. (Friday, Sept. 7, 2012) – As our population ages and lives longer, employers may face challenges meeting their pension promises to employees. International experts in the fields of insurance and risk are discussing the financial costs of living longer as they meet at the 8th International Longevity Risk and Capital Markets Solutions conference, hosted by the University of Waterloo.

“We are pleased to have delegates here from all over the world, including both academics and practitioners," said Professor Johnny Li of the Department of Statistics and Actuarial Science at Waterloo, and conference chair. "This is the first time this conference has taken place in Canada, and it will play an important role in sharing the most up-to-date information about longevity risk and its potential solutions."

More than 160 leading minds, including policy makers and world experts from industry and academia, are meeting discuss not only the assessment of longevity risk, but also the market and government developments and responses needed by pension funds and insurance companies in order to manage this risk.

"Canadians are living longer, which is a good thing—but most employers aren't preparing themselves for this shift when it comes to their defined benefit pension plans," said Brent Simmons, senior managing director of Defined Benefit Solutions at Sun Life Financial and one of the keynote speakers. "Participating in this global conference increases awareness of longevity issues, and provides employers with the knowledge necessary to ensure that they meet their pension promises."

Some companies are already implementing plans to deal with this trend. Sun Life Financial and Prudential Financial are two of the sponsors of the conference, and are among the organizations there providing expertise and innovative solutions to help companies manage these risks.

"Leading corporations in the UK, US and Canada are taking bold steps today to de-risk their pension plans allowing them to focus on their core business, create more consistent financial results and set themselves apart from their peers," said Amy Kessler, a senior vice-president and head of longevity reinsurance at Prudential Financial.

The two-day conference starts today, and is possible largely through the generous support of its sponsors. For more information on the conference, please visit www.longevity-risk.org.

In just half a century, the University of Waterloo, located at the heart of Canada's technology hub, has become one of Canada's leading comprehensive universities with 34,000 full- and part-time students in undergraduate and graduate programs. Waterloo, as home to the world's largest post-secondary co-operative education program, embraces its connections to the world and encourages enterprising partnerships in learning, research and discovery. In the next decade, the university is committed to building a better future for Canada and the world by championing innovation and collaboration to create solutions relevant to the needs of today and tomorrow. For more information about Waterloo, please visit www.uwaterloo.ca.

-30-

Pamela Smyth

Media Relations Officer

University of Waterloo

519.888.4777

Waterloo news release no. 68

Read more

The faculties of Science and Arts introduce a new theatre and performance course tailored to Science students

Read more

Waterloo’s WatSPEED to provide businesses with access to AI upskilling programs in new province-wide initiative

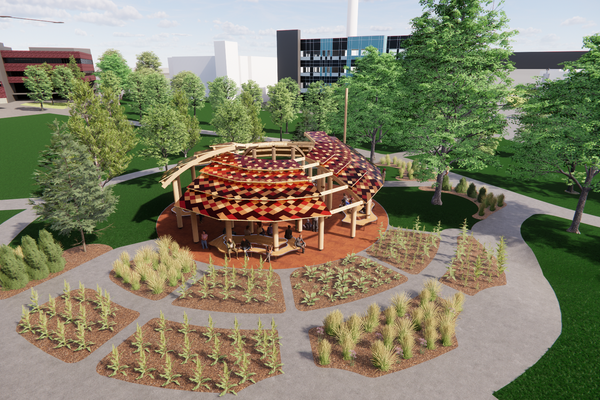

The University of Waterloo recently broke ground for the new space, scheduled for completion by this fall.

Read more

Construction begins on Indigenous outdoor gathering space at University of Waterloo

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations.