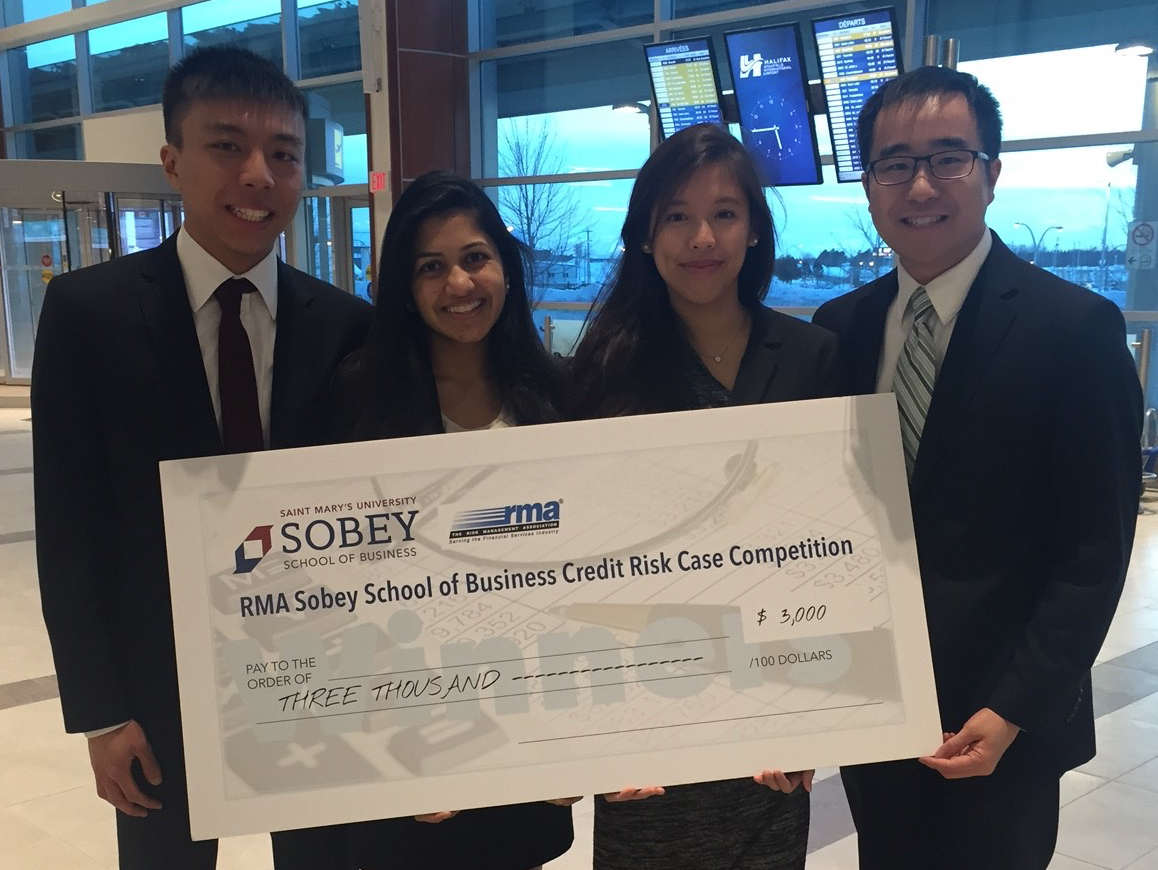

SAF student team places 3rd in Credit Risk Case Competition

by Patty Mah, Associate Director Admissions and Communications

The School of Accounting and Finance (SAF) student team - Joseph Chiu, Archana Chittella, Rosanne Lai and Jeffrey Wong, all MAcc students - faired well at the competition, placing 3rd behind MBA students from University of Toronto (2nd) and University of Western Ontario (1st).

The SAF team experienced additional challenges due to a flash freeze in Halifax causing power outages in their hotel during the first day of the competition. Creativity and ingenuity kicked in and the team cobbled together their electronic devices and bottles of water to create enough illumination in their hotel room to review the case and plan their strategy.

"During the crisis round of the finals, our team collectively thanked our professors for teaching us the knowledge that let us quickly assess the implications of a change in ownership structure as well as tax implications of HST refunds. It's in moments like these when we truly realize the value in the years that we've spent at the School of Accounting and Finance."

Judged by industry insiders, the competition challenged students' analytical skills, business education and presentation skills, in identifying and mitigating the credit risks that North American businesses face. Students were provided with a business case which focuses on the real world challenges of managing credit risk in a rapidly changing and increasingly turbulent business environment.

Although challenging, our case training during MAcc and technical training during our undergrad in financial reporting, management accounting, assurance, and taxation provided us with different views that allowed us to branch away from finance and look at real-life multidisciplinary business considerations when assessing commercial lending transactions. Overall this gave us a competitive edge in providing simple and elegant solutions to the otherwise complex problems presented in the competition."