By: Carrie Gilmour

Waterloo Region is Canada’s top innovation hub. It is home to the second highest density of start-ups in the world after Silicon Valley, and is a top 25 innovation ecosystem in the world (Startup Compass 2015).

The School of Accounting and Finance (SAF) has launched the Student Venture Fund (SVF), in partnership with the Conrad Business, Entrepreneurship and Technology Centre (Conrad Centre). The objective is to develop elite venture capital investors by giving students the opportunity to invest real money in real companies under the guidance of experienced investors and faculty.

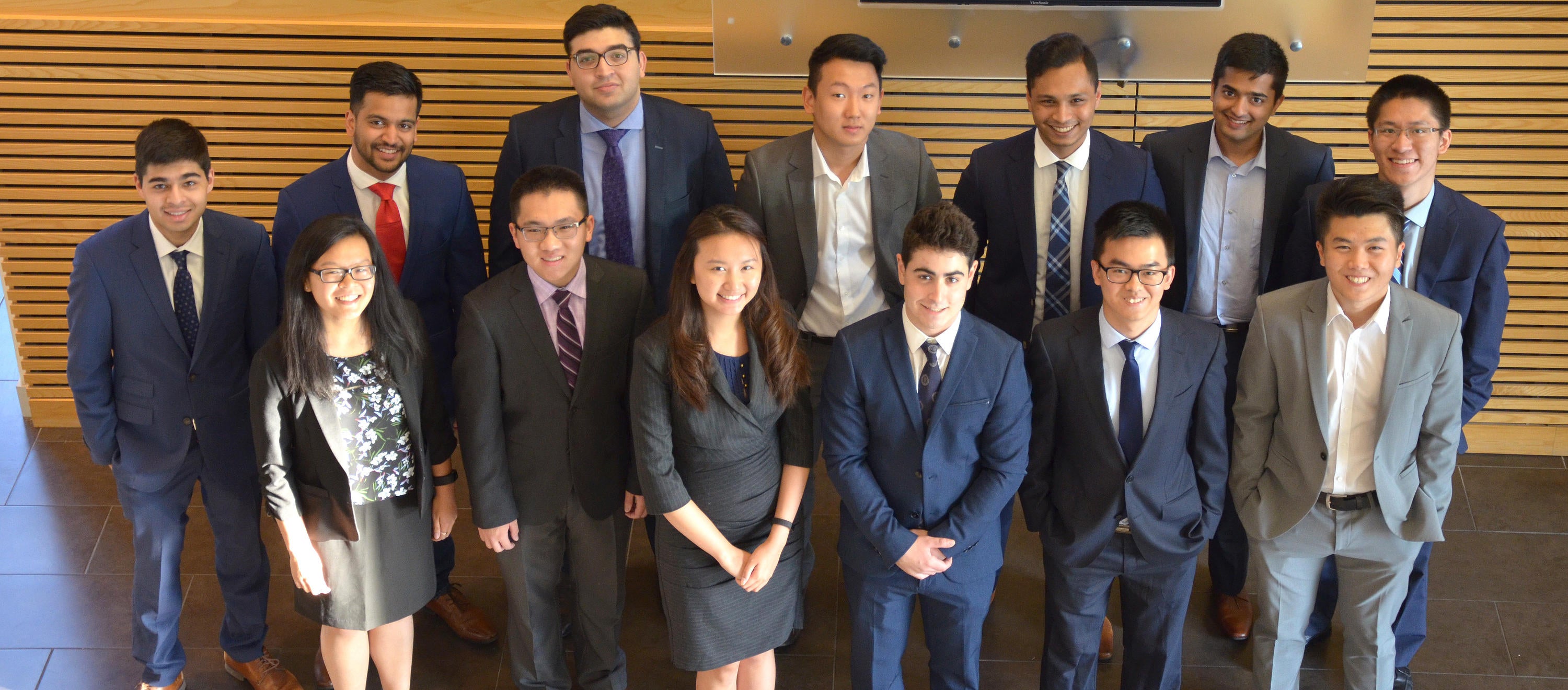

Fall 2017 Student Venture Fund team from back (l-r) Ameer Dharamshi, Raj Patel, Ismail Mian, John Youn, Aniket Patel, Muhammad Haider, Kevin Zhou, bottom row (l-r) Annie Shi, Jimmy Zhou, Jacqueline Sue, Joseph Vaccaro, Daniel Liu, Ryan Chiu.

Mentored by SAF Professors, Ranjini Jha, Frank Hayes, and Mark Arnason, students will evaluate founding management, complete market research, value companies, and make investment recommendations. The SVF will work closely with angels and institutional investors and specialize in early stage technology companies, many of which are located here in The Region.

Tim Jackson, President & CEO of Shad and Sessional Faculty at the Conrad Business, Entrepreneurship and Technology Centre, elaborates:

In venture capital investing, you’re investing in people, so you need to know how to manage relationships. There is an important human element to the job, and that is difficult to teach in the classroom. By participating in the SVF, however, students will learn through direct experience how to build relationships in which they are viewed as trusted partners.

With less publicly-available information, venture capital investors must rely more on face-to-face interactions to make their assessments. Students in the SVF will attend investment meetings, meet with key entrepreneurs and employees, conduct financial due diligence and prepare comprehensive investment memoranda and recommendations.

When you’re learning about publicly traded stocks, there is a lot of credible information available. As a result, it’s not hard for students to apply the theory they learned in class to valuations,” says Ranjini Jha, Associate Professor, Finance. “With early-stage firms, by contrast, there is very little public information available. The entrepreneur has an idea and perhaps they have tested it or are in the process of developing their product—but that’s it. As a result, there is much more emphasis on the people behind the business.

The Fund is open to students in programs at the School of Accounting and Finance and to students in the Master of Business and Entrepreneurship and Technology (MBET) program at the Conrad Business, Entrepreneurship and Technology Centre (Conrad Centre).

Jacqueline Sue, a fourth year Accounting and Financial Management (AFM) student is using this experience as a launching pad for a potential career.

After hearing about this opportunity and seeing how the School of Accounting and Finance is placing an emphasis [on venture capital investing], it goes to show where business is heading. It’s not just accounting and finance, there’s a future in entrepreneurship as well as investing in entrepreneurship. I’m really excited for this. This is a potential career path for me and having an accounting and finance background will help me in this innovative experience.

SAF students will have firsthand experience by integrating their knowledge from the classroom and co-op to go beyond ideas to finance the innovative entrepreneurs of Waterloo.

Interested in applying to SAF programs? Check out our Future Students website. Plus, see how other University of Waterloo students have gone #BeyondIdeas.