Introduction

Climate change has important consequences for the world’s freshwater resources, in particular their availability in time and space. The frequency and intensity of extreme weather events resulting in floods and droughts are expected to increase. Worldwide, practitioners and researchers develop, implement and investigate a wide array of possible climate change adaptation and mitigation measures. Traditional supply management and engineering solutions are increasingly supplemented by demand management policy tools and instruments, aiming to change human behaviour with respect to water use. In addition to water regulation during times of scarcity and education and awareness raising campaigns, water pricing is generally considered to be among the most prominent demand management approaches, despite the price-inelastic nature of many forms of water demand. Many water uses are not priced, and well-developed markets where water can freely be traded only exist in a few places around the world. Numerous studies exist that discuss, both theoretically and empirically, existing pricing principles. However, the number of studies investigating the economic efficiency of water markets and trade among different water users is very limited.

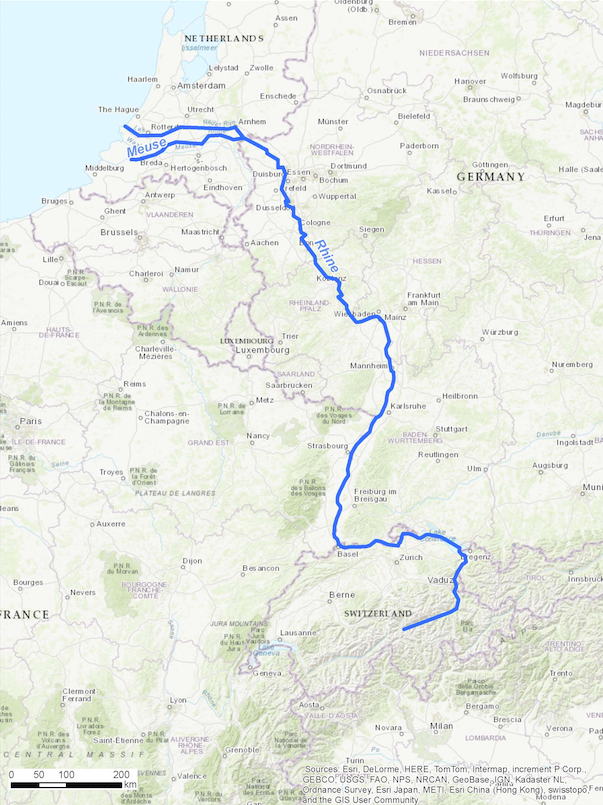

In this study, we assess the potential role of water markets as a climate change adaptation tool. To this end, we investigate the economy-wide impacts of the creation of different water markets, using an economic model that allows us to investigate the role and value of water in agriculture, the manufacturing industry and public water utilities in the different countries that are part of the transboundary river basins of the Rhine and the Meuse (Figure 1). These two rivers are among the longest in Europe, and together supply the Netherlands with almost all surface water inflow. The Rhine River is almost 1,250 km long, originates in Switzerland and flows through Germany and France before it drains into the North Sea in the Netherlands. The Meuse River is almost 950 km long, originates in France and flows via Belgium into the North Sea in the Netherlands. Officially, the government owns the water flowing through the Rhine and Meuse rivers, and is responsible for their sustainable management. Introducing a water market means that water rights have to be allocated to the different water users, after which they are allowed to trade their water rights among themselves and with other user groups.

Figure 1. Map of Rhine River and Meuse River

Methodology

Raw or natural water is introduced in the economic model as a production factor in various sectors, including: public water services; crop production; animal husbandry; the food industry; clothes and textiles; paper and pulp; metal manufactures; basic chemicals; and other manufacturing. The availability and allocation of raw water across these different economic activities is calculated under one of the climate change scenarios developed by the Netherlands Royal Meteorological Institute, which predicts substantially warmer and dryer summers and a significant decrease of the water flow levels in the two rivers by 2050. The higher temperature and lower precipitation would negatively impact the productivity of land for agricultural use, while the reduced precipitation and river discharge would lead to less water availability for economic use. These climate conditions are expected to extend across the entire international basin of the two rivers.

Four types of water markets were modelled under these new climate conditions:

- No water market.

- Two water markets (agriculture and industry).

- Single water market (agriculture + industry) including public water services.

- Single water market without public water services.

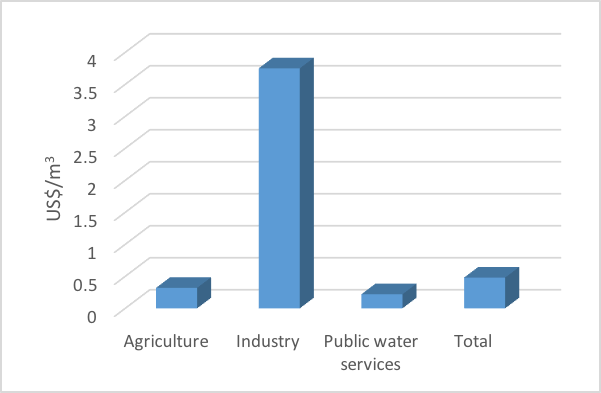

In the scenario with two water markets, water can only be traded between agricultural sectors in an agricultural water market, and between the manufacturing sectors and the water services sector in an industry water market. In the single water market, one market supplies all sectors and all water-using sectors participate in a unified market resulting in a single price for water across all uses. Since drinking water is typically prioritized when there is water scarcity in most countries, the economic impacts of a single market are also simulated without the participation of the public water utilities. The average value of water under baseline conditions is presented in Figure 2. These are the values for self-abstracted raw water for which currently no price is paid since there exists no market for self-abstracted raw water. Major assumptions in this study include that (i) water is allocated to the different economic activities based on their current use, (ii) trading involves no transaction costs, and (iii) water is mobile and can be transported free of charge across different uses and user groups.

Figure 2. Average baseline value of water across the main water use categories in the Netherlands

Outcomes

The economy-wide impacts of the separate and single water markets were estimated for the Netherlands and compared to the economy-wide impacts of climate change without a water market, and for the international river basins as a whole. The results show that instituting water markets moderates the impact of climate change on the economy. The impact of climate change on overall Gross Domestic Product (GDP) loss is -0.024% without water markets, while the moderating effect of water markets seems almost negligible (Figure 3), reducing the loss to -0.021%. GDP in the Netherlands was almost US$771 billion in 2016, hence this seemingly negligible moderating effect yields a reduction in loss of US$2.3 billion. In all scenarios, results show that water is re-allocated from lower value added activities such as agriculture to higher value added generating activities such as manufacturing. Industry is able to somewhat increase its output (0.05-0.07%), while agriculture loses output, especially in the single market without the public water services (-2.33%).

Instituting water markets also has an effect on water-using sectors in the upstream countries which share the river via trade linkages. Not surprisingly, since the Dutch climate change scenario was extrapolated to the whole transboundary basin, surrounding river basin countries suffer similar relative losses compared to the Netherlands. Dutch agriculture is slightly better protected from climate change since a larger share is irrigated and hence less vulnerable to extreme weather events.

Figure 3. Economic impact of climate change and water markets on GDP and the main water use categories in the Netherlands

Conclusions

Although the assumptions related to the design of water markets and their associated transaction costs need further investigation, the results seem to hold promise for the introduction of innovative institutional-economic climate adaptation tools in Europe such as water markets to allocate water across competing uses and users in times of scarcity. These water markets can operate at both national and transboundary river basin scales. Further economic optimization is needed to minimize the associated transaction costs across spatial scales, and the economic costs and benefits of water markets have to be compared to other cost-effective water supply side solutions.

|

Levin-Koopman, J., O. Kuik, R. Tol, and R. Brouwer (2017). The potential of water markets to allocate water between industry, agriculture, and public water utilities as an adaptation mechanism to climate change. Mitigation and Adaptation Strategies for Global Change 22(2), 325-347. Contact: Roy Brouwer, Department of Economics For more information about the Water Institute, contact Amy Geddes.

|