A full copy of this paper can be obtained from co-author, Dr. Adam Vitalis at the University of Waterloo, Canada (avitalis@uwaterloo.ca)

Introduction

In recent years, Corporate Social Responsibility (CSR) has taken on more importance and visibility. Boards and CEOs convey their support for CSR by allocating budgets; many give middle managers discretion to spend these monies as they see fit. By decentralizing CSR budgets, firms hope to simplify CSR administration, better motivate managers and their teams, and leverage managers’ knowledge of their communities to make better CSR investment decisions.

Despite leadership’s desire to increase CSR spending, however, some managers do not believe in redirecting profits or shareholder returns to societal causes. Not surprisingly, these CSR non-supportive managers spend significantly less of their budget than those who support CSR. In this study, the researchers sought to understand whether a benign nudge might cause managers to spend more of their CSR allocations.

With undergraduate students and managers as participants, the researchers devised a series of experiments. Subjects were placed in scenarios in which they could spend up to $1,000 to support tree planting, but the more they spent planting trees the lower their personal renumeration for participating. Both pro and anti-CSR managers were asked how many tree plantings they would support at $1 per tree. One group of participants was asked how much money they would allocate to tree planting. Another – the nudge group – was asked how many trees they would plant.

Rationally, managers should not be swayed by either version of the question because each represents exactly the same proposition: $1 per tree planted. Nonetheless, the researchers hypothesized that by simply framing the question differently, the non-economic frame (the nudge) would better align with CSR supportive managers, leading to increased CSR spending.

In each experiment, the researchers confirmed their main hypotheses: the nudge caused some managers – those who support CSR - to spend significantly more but had no effect on anti-CSR managers. Where a manager is already pro-CSR, nudging them into a CSR supportive mindset when deciding how much to allocate to tree planting causes them to spend more.

Assumptions Tested (Hypotheses)

In most circumstances, managers will decide how much to allocate to a CSR cause in dollar terms. The researchers believe that this puts them into a traditional financial mindset of costs and benefits. However, when the activity is framed in terms of the number of trees planted, meals distributed, etc., it aligns the giving with personal norms (i.e., increases salience). This triggers the relevant social values of managers who support CSR. In determining how many trees to plant (pay for) they will think less about costs and benefits and more about the good being done by the firm. This will cause them to spend significantly more. Again, prior to the experiments, the researchers reasoned that this effect would apply only to pro-CSR managers because non-CSR supportive managers don’t possess the social values activated by the nudge.

The Experiments

- Potential participants were tested two weeks before the experiments to determine their support of CSR. Those who were either clearly pro or anti-CSR were selected.

- In the main experiment, 34 undergraduate students assumed the role of a corporate manager within a pro-CSR firm who is allocated up to $1000 (in experimental “EXP$” dollars) to spend on tree planting. Participants are told that 1% of whatever they spend actually goes to a tree planting organization, and 1% of what they don’t spend goes to them.

- Participants were randomly selected into two groups. One group decided how much money to spend on planting trees, the other how many trees to plant. Again, both groups knew that each tree cost $1 to plant.

- In a separate experiment, instead of dollars, 38 different undergraduate participants – all pro-CSR – were given company “credits” in determining how many tree plantings to pay for. One credit equaled one dollar. Participants could spend up to 1,0000 credits.

- As part of the same experiment, participants were also given a double condition. They were asked to complete either statement: “I want to spend $______ planting ______ trees,” or “I want to plant ______ trees for $______.”

- Finally, 38 experienced managers were put through the main experiment but asked to imagine a higher budget (between $100,000 to $300,0000 on tree planting).

Results

- In the main experiments – involving both undergraduates and professional managers – pro-CSR participants spent significantly more when nudged with the non-financial condition. Pro-CSR managers spent more than non-supportive CSR managers, and significantly more when their choices were framed in terms of the number of trees they chose to plant (non-financial) versus the amount of money they decided to spend (financial/economic).

- The researchers predicted that pro-CSR managers would spend more because the non-financial frame triggers their pro-social values. However, an alternative view could be that the difference was due to the financial frame suppressing pro-social inclinations, causing them to spend less. To address this concern, participants in the credit condition – one that neutralizes both financial and non-financial triggers – spent far less than they did in the non-financial condition. This lends strong weight to the researchers’ hypothesis that pro-social triggers are activated when the choice is presented as number of trees versus amount of spend (impact vs. money).

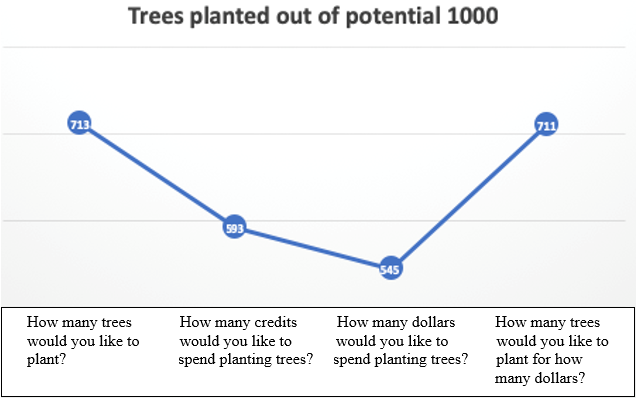

- In work settings, managers would most likely consider both quantity and price. That is, they would think along the lines of how many trees they can get planted at what cost. Remarkably, when pro-CSR participants are asked to make a choice: “I want to plant ______ trees for $______” vs. “I want to spend $______ planting ______ trees,” the difference between the non-financial and financial frames holds. This too lends tremendous support to the researchers’ hypotheses (Figure 1 provides a stark illustration).

Figure 1. Number of trees planted by pro-CSR managers by condition

Key Takeaways

- Even when spending on CSR reduces their compensation, managers who support CSR spend considerably more on CSR than managers who do not support CSR. More surprisingly, pro-CSR managers can be easily nudged to spend more than they would otherwise simply by framing their choices to emphasize the impact of their contribution vs. the cost.

- Firms that decentralize CSR spending and that aim to increase spending on CSR activities should first hire candidates who believe strongly in CSR and then frame CSR spending choices to emphasize impact.

Questions about the research? Please contact Dr. Adam Vitalis at avitalis@uwaterloo.ca or Dr. Xi Jason Kuang at jason.kuang@scheller.gatech.edu.