Eligibility

If you have met the eligibility criteria, pension plan participation is voluntary under the age of 35.

If you are under 35 years of age when hired and you meet the eligibility criteria set out in the table, you may join the pension plan on the date of hire (if hired on the first of the month) or the first of any month following the date of hire. If you do not join when eligible and choose to waive eligibility, you must join on the January 1 following or coincident with your 35th birthday. Please note that service cannot be bought back at a later date.

| Faculty incudes post doctoral fellows and research associates | Permanent ongoing or an appointment or series of consecutive appointments greater than one year |

|---|---|

| Definite term lecturers | Fixed appointment or series of consecutive appointments greater than one year Note: must join on the first day of the month following the completion of 5 continuous years of employment. Follows Faculty eligibility when promoted to higher rank of faculty appointment, including continuing lecturer. |

| Staff | Permanent ongoing or a contract or series of consecutive contracts greater than two years |

| Casual employees and employees with less than 1/3 annual commitment | Earned at least 35% of the year's maximum pensionable earnings (YMPE) or worked at least 700 hours, in two consecutive calendar years | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Once you have joined the pension plan you must remain a member of the plan and cannot suspend membership until your employment is terminated.

Notes:

- Separate periods of ongoing regular employment will be considered a single period of continuous employment for pension purposes if the periods are separated by no more than 12 months during which you were not employed by the University, or no more than 18 months where the earlier period of employment was terminated as a result of an organizational restructuring under which your position was eliminated, provide you have left your pension accrual in respect of your first period of employment in the pension plan.

- Once a member has joined the pension plan, they must remain a member of the plan and cannot suspend membership until their employment is terminated.

Contributions

Members are required to contribute to the pension plan as follows:

- 7.80% of base earnings up to the year’s maximum pensionable earnings (YMPE) plus

- 11.20% of base earnings exceeding the YMPE

In addition, you are required by law to make Canada Pension Plan contributions. The current Canada Pension Plan contribution rate is 5.95% of earnings between the basic exemption (BE) of $3,500 and the YMPE. Starting in 2024, you and the University are required to make additional CPP contributions equal to 4% of earnings above the YMPE, up to the new Year’s Additional Maximum Pensionable Earnings, or YAMPE.

The University funds the balance of the cost of the pension benefits you earn under the pension plan, as determined by an actuarial valuation filed with the regulatory authorities. University funding of the plan is well in excess of members' aggregate contributions. The University also matches all contributions made to the Canada Pension Plan.

How to join

- Initiate the business process of joining the pension plan through Workday.

Transferring to the UWaterloo Pension Plan

Employees hired by the University of Waterloo or one of the colleges (UW) who participated in a Canadian registered pension plan with their previous employer* (prior plan) within six (6) months prior to being employed by the University of Waterloo, may transfer pension money payable from their prior plan to the UW pension plan (UW Plan) provided the following conditions are met:

*must be the employer immediately prior to joining UW or a college

- You are eligible to join and have become a member of the UW Plan;

- You have submitted a completed application form to Human Resources (HR) within six (6) months of being employed by UW, or, if later, within six (6) months of first being permitted to transfer the pension funds based on the terms of your prior plan and any applicable legislation;

- You have provided HR with the following information from your previous employer or the administrator of your prior plan (it is your responsibility to obtain this information and provide it to HR because your former employer or the administrator of your prior plan might not release this information to us directly):

- Pensionable earnings, credited service (total number of years and months that you made contributions to your prior plan) and pension adjustment history;

- Certification that no benefits will remain payable from the prior plan after the transfer has been completed

- The Pension and Benefits Committee consents to the transfer.

Once you have submitted a signed application form, along with a copy of your pension option statement from your prior plan, our actuary will determine the amount of credited service the transferred money can purchase under the UW Plan. There are a variety of factors that impact whether you will be able to purchase the full amount of credited service you earned under your prior plan, but the calculation is meant to be cost-neutral at the time of transfer.

If the funds available for transfer cannot purchase the full amount of credited service you earned under your prior plan, you can purchase the additional service by making a "top up" payment. The amount of payment required is determined after the transfer is received from your prior plan. You will not be able to purchase more credited service under the UW Plan than you earned under your prior plan. In this case you will need to transfer the balance of funds available for transfer from your prior plan somewhere else, such as to a personal Registered Retirement Savings Plan (RRSP).

There may be RRSP contribution room implications if the total pension adjustments under the UW Plan associated with the credited service you are purchasing are greater than the total pension adjustments reported to the Canada Revenue Agency (CRA) by your prior employer. If this is the case, a Past Service Pension Adjustment (PSPA) must be reported to CRA who will certify that you have RRSP contribution room. CRA will reduce your RRSP contribution room by the PSPA amount. A PSPA can only be determined once we have received the information outlined in #3 above from your previous employer or plan administrator.

There are both advantages and disadvantages to consider regarding transferring pension money from another pension plan.

Advantages:

- You consolidate your pension savings under one plan, so there is no need to keep in contact with the prior plan administrator

- Over time the value of the service purchased will increase and we can project the defined benefit pension you are entitled to in respect of the service purchased

- The UW pension funds are professionally managed

Disadvantages:

- Any non-locked-in pension money that is transferred to the UW Plan to purchase service becomes locked-in and cannot be withdrawn in cash from the UW Plan

- You do not make any investment choices

- You may not be able to purchase as much service under the UW Plan as you had earned under your prior plan

Additional Information:

The Income Tax Act, Canada (ITA) restricts the maximum amount of pension that can be paid from a registered pension plan. UW provides additional pension in excess of the ITA limit to high income earners from a non-registered pension plan. The pension in respect of credited service purchased by money transferred in from your prior plan is not eligible for the additional pension from the non-registered pension plan. The pension provided by credited service purchased by money that was transferred into the UW pension plan will be limited to the ITA limit in effect in the year of retirement.

An Application for Approval to Transfer Pension Funds into the University of Waterloo Pension Plan can be found on the forms page of the HR website. You will need to provide HR a copy of the termination option statement you received from your former employer as well as the information outlined under #3. Providing this information along with a signed application form does not mean you are obligated to proceed with the transfer, but ensures you have met the transfer-in deadline noted in #2.

Please contact pensions@uwaterloo.ca to obtain an application form, of if you have any questions.

Naming a beneficiary

Since the plan, in certain circumstances, provides for payments to be made to a beneficiary in the event of your death, it is important that you designate the person or persons to whom you wish this money to be paid. If you have not named a beneficiary, or if there is no surviving beneficiary, any lump sum benefit due under the plan will be paid to your estate, less appropriate income tax withheld. If the beneficiary named is a person under the age of 18, it is strongly recommended that you name someone in trust for them.

Spouses have certain entitlements under the pension plan. If you elect to designate someone in addition to or in place of your spouse as your pension beneficiary, we require a completed pre-retirement waiver form (PDF), signed by both you and your spouse.

Changing your beneficiary designation

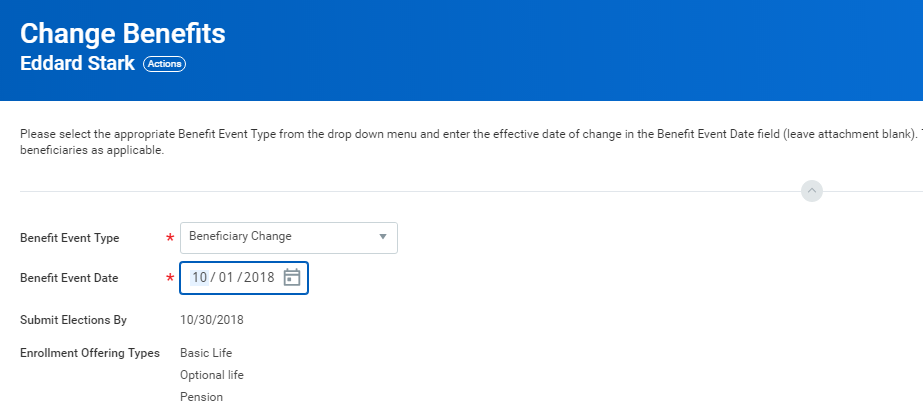

Log onto Workday to access the Benefits application:

- Click the Benefits button under Change.

- Select the Benefit Event Type.

- Click the Calendar icon to enter the date of the Benefit event.

- Attach required documents, if applicable.

- Click Submit.

- Click Open on the next screen to complete this task right away (or go to your inbox to complete).

- Complete and continue through all required screens. Check the I Agree checkbox, if required, to provide an electronic signature, confirming your changes.

- Click Submit.

- Click Done to complete the task or Print to launch a printable version of the summary for your records.

If the beneficiary you wish to designate is not already in Workday, you will be prompted to add a new beneficiary record.

As a wet signature is required to finalize your designation, you will receive a notification to print and complete a beneficiary designation form. The original signed copy must be returned to HR by campus mail. Please ensure the paper form matches the designation that you input in Workday.

If the beneficiary named is a person under the age of 18, it is strongly recommended that you name someone in trust for them. Also, note that spouses have certain entitlements under the pension plan. If you elect to designate someone in addition to or in place of your spouse as your pension beneficiary, we require a completed pre-retirement waiver form (PDF), signed by both you and your spouse.

Detailed instructions can be found in the beneficiary change instructions. Please contact hrhelp@uwaterloo.ca or extension 45935 for any questions.

Key terms

FTE: Full-Time Equivalent. 100% FTE means you work full-time.

YMPE: The year's maximum pensionable earnings (YMPE) and the year's additional maximum pensionable earnings (YAMPE) are defined in the Canada Pension Plan Act.

Base earnings: Basic monthly or weekly salary excluding overtime, reimbursement for expenses, shift premiums, special allowances, stipends and other like payments.

Spouse is defined as a person to whom the member is:

- Legally married, provided the member is not living separate and apart from that person; or

- Not legally married, but the member and that person are cohabiting continuously in a conjugal relationship for at least three years; or,

- Not legally married, but the member and that person are cohabiting in a conjugal relationship of some permanence, and are jointly the natural or adoptive parents of a child, both as defined in the Family Law Act, 1986 (Ontario).