Insuring a global pandemic

COVID-19 and climate change set to impact the insurance industry significantly

COVID-19 and climate change set to impact the insurance industry significantly

By Ryon Jones Faculty of MathematicsThe repercussions of COVID-19 and worsening climate change are among the issues that will impact the insurance industry, according to Tony Wirjanto, University of Waterloo professor.

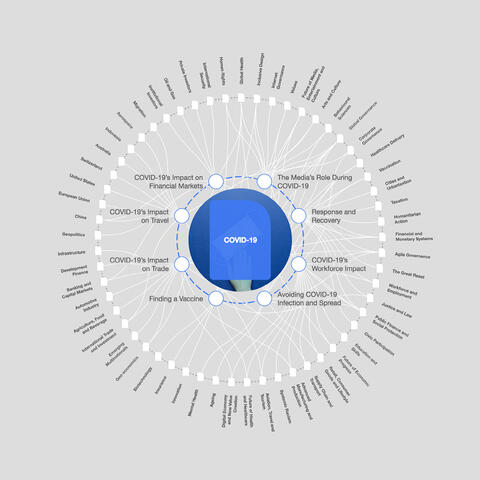

Wirjanto, working as a curator in Insurance and Asset Management for the World Economic Forum (WEF), identified eight key issues poised to influence the insurance industry in the recently released WEF Transformation Maps.

Transformation maps are dynamic knowledge tools that help users explore and make sense of complex forces transforming industries. It allows leaders in that space to visualize and understand more than 250 topics and their connections between each in one place. The result helps support better-informed decision-making.

The eight issues explored in the insurance transformation map, in this case specifically, are big data, commoditization, privacy trends, cyber risk, artificial intelligence, insurtech, Internet of Things and climate change. COVID-19 will be the latest topic to be added.

According to the insurance transformation map, climate change is a systemic and irreversible process that introduces sensitive paradigm shifts to insurers’ risk-return profiles — significantly affecting both the asset and liability sides of their balance sheets. Climate change risk affects both the “property & casualty and life” insurance sectors in several important ways. These, in turn, pose a threat to the reinsurance industry through coverage of exposures that are in excess of insurers’ capacities.

Wirjanto believes the insurance industry may, in the end, be able to survive the COVID-19 pandemic as it has done in other notable crisis episodes in the past. However, to do so, insurers need to quickly determine how best to meet the needs of their employees, brokers and customers with products, financing, sales and service that work best in the presence of the unprecedented scale of this pandemic crisis.

“This project started before the pandemic, and this is why I haven’t included the impact of COVID-19 in the initial insurance transformation map,” Wirjanto, a professor jointly appointed in Waterloo’s School of Accounting and Finance and Department of Statistics and Actuarial Science, explains.

“My job is to update these key issues every three to four months over the next five-and-a-half years, and I will include the impact of COVID-19 for each of the eight key issues in the next edition.”

The maps are driven by an AI algorithm that anticipates what type of information policymakers and public officials may need. The curator then collects relevant and actionable information and makes it available in one linkable source to aid the decision-making process.

In coming up with the map’s content, Wirjanto and his team, former PhD student Mingyu Fang (’19 ActSc) and Rong Brenda Dang, a current master’s student in the Computational Mathematics program, undertook a tremendous amount of research to ascertain the challenges CEOs working in the insurance industry face.

Based on research, Wirjanto believes worsening climate change and the global responses to the COVID-19 pandemic so far have highlighted the need for insurers to adopt various innovative approaches. These methods include customer-centric digital tools and other innovations that respond to stakeholders’ needs in times of a crisis, such as online payment of premiums and claims and acceleration of digitization adoption to improve data collection, products and customer relations.

“It has become increasingly clear that insurers need to tailor their products and processes to accommodate differing risk profiles as well as differing needs of their diverse customers and work to mitigate the extent to which this pandemic crisis further widens the existing gender gap, income gap, etc.,” Wirjanto says. “Whereas the climate change-related impacts merit greater amounts of risk-related research in the insurance industry.

“Integrated assessment models, which can aggressively leverage cross-disciplinary tools from climate science, finance and actuarial science, should increasingly be used for robust quantitative analyses of risk and effective qualitative studies on the subject will also be valuable.”

Interested to hear how green innovation is driving our economic recovery? Register for our next Waterloo Innovation Summit scheduled for November 30, where industry leaders will explore how green innovation and sustainable enterprises can drive economic growth while ensuring our planet’s future.

Read more

Urban engineering chair argues we have a golden opportunity to do it right, with a concerted effort, when we do go back to a new normal

Read more

The Great Lakes are the largest freshwater system in the world - what happens to our economy when they are damaged by climate change?

Read more

Every day we learn about the number of new positive cases, the number of deaths and the number of resolved cases of COVID-19. But is there more information we should be collecting about who the virus is infecting?

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg, and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations.