University of Waterloo will put its money where its mouth is with VC fund investment

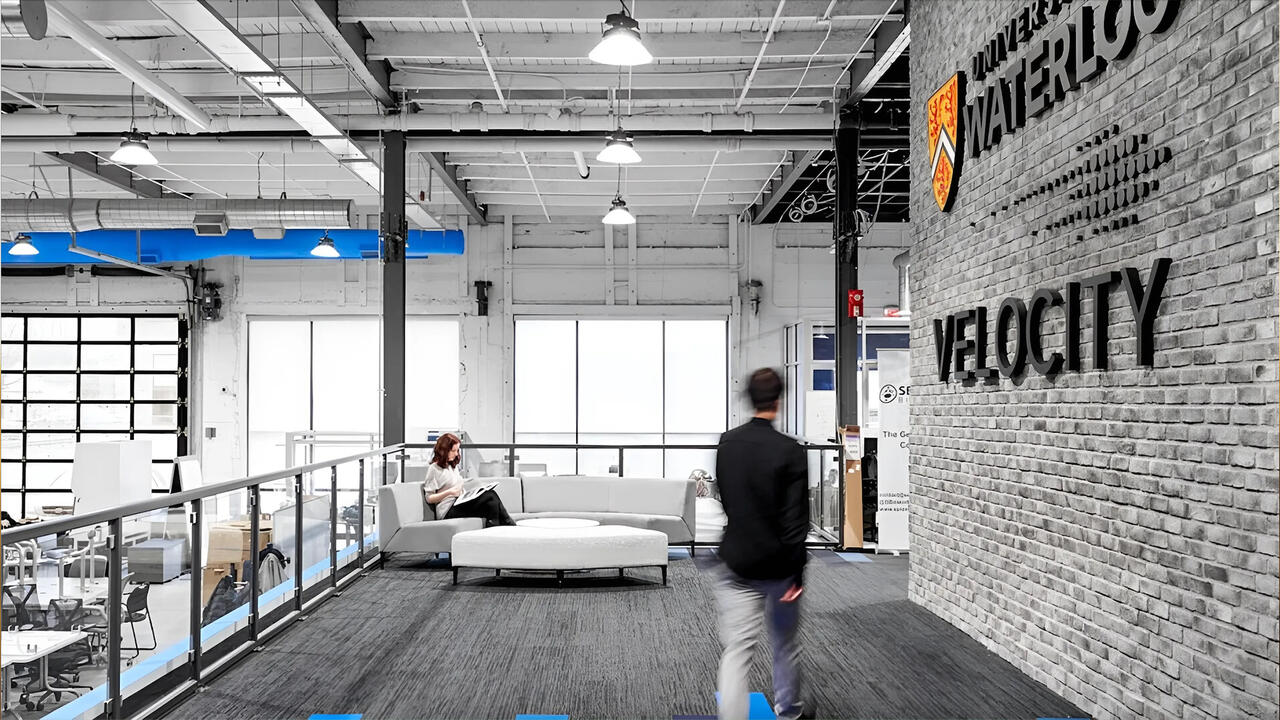

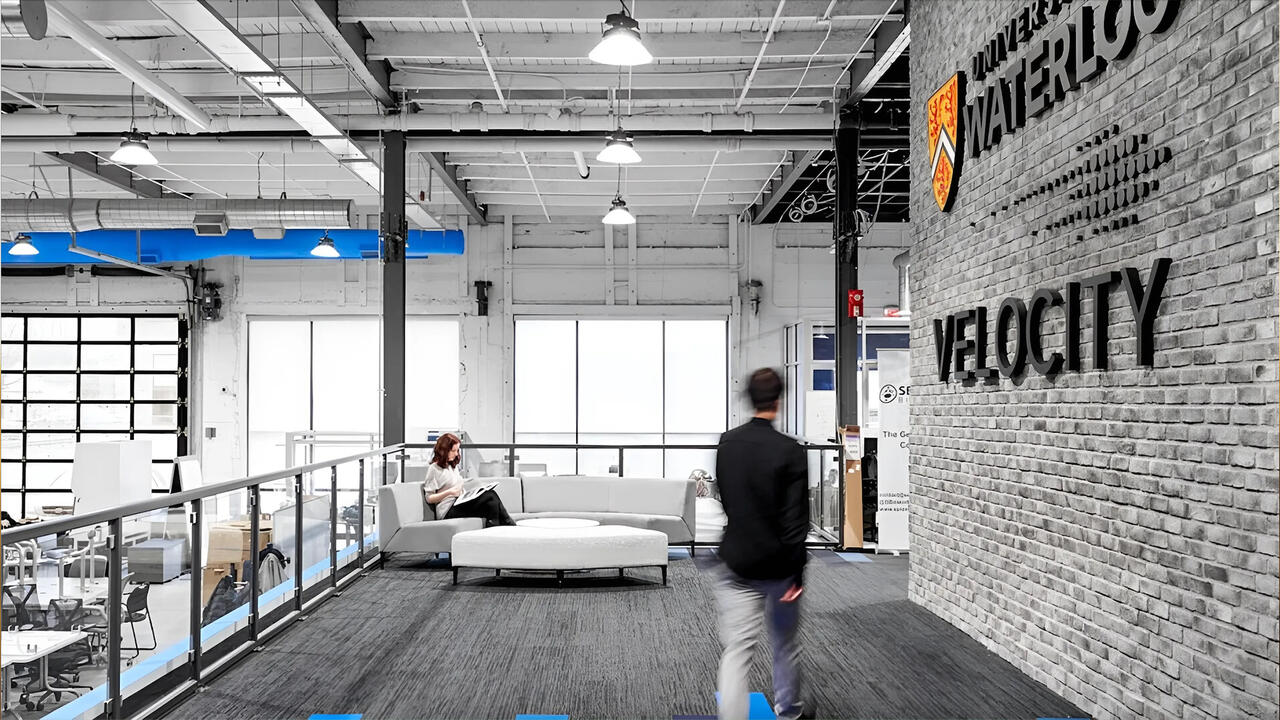

Velocity Fund II is a new, for-profit VC fund spun out of Waterloo’s Velocity incubator and operated independently

Velocity Fund II is a new, for-profit VC fund spun out of Waterloo’s Velocity incubator and operated independently

By Media RelationsThe University of Waterloo will become the first post-secondary institution in Canada to invest from its endowment into a venture capital (VC) fund launched by the team behind its affiliated startup incubator.

Waterloo’s Board of Governors recently approved an investment of up to $5 million into the Velocity Fund II (VFII), a new, for-profit VC fund operated independently by general partners Ross Robinson and Akash Vaswani which was spun out of Waterloo’s Velocity incubator.

Akash Vaswani and Ross Robinson, general partners of VF II

“At Waterloo we have always taken pride in our unconventional spirit. This approach to supporting entrepreneurs in our ecosystem – many of whom study at Waterloo – is just another example of how we are doing things differently,” said Dr. Vivek Goel, president and vice-chancellor of Waterloo. “We know that the University’s investment in the talent in our region will be returned, and we are excited to support these founders as they tackle some of the most pressing issues in our society.”

The University’s Finance & Investment Committee supported the move to invest from the endowment based on the practice of “ecosystem capital” - an emerging trend of capital sources being used to fund early-stage startups within the capital source’s ecosystem. This practice has great benefit for the economy tied to the ecosystem of reference – in this case Waterloo – and for startups already in place – in this case, those at Velocity.

“The University’s donors have been yearning for the endowment to play a more active role investing in outstanding Waterloo startups, and we’re excited that this investment into the Velocity Fund II could be just the beginning, and at such an opportune point in the economic cycle.” said Michael Ashmore, chair of the Finance & Investment Committee at Waterloo. "This move will further cement Waterloo's position as Canada’s leading tech startup University and is a solid choice for our initial investment given the proven financial success Velocity has achieved in early-stage venture capital over its 14-year history.”

Canada has a well-documented innovation gap - ranking sixth among G7 nations and 15th overall in the World Intellectual Property Organization’s 2022 global innovation index. In addition, early stage (pre-seed and seed) investment has been lacking in Canada’s R&D pipeline, with high excess valuation markup rates for Waterloo startups documented by AngelList. This ranking indicates the long-term success of Velocity companies, but also the need for more and better early-stage funding for Canadian entrepreneurs. The VFII will aim to fill this innovation gap by providing early support for software and deeptech early-stage startups, coming out of Waterloo, Velocity and the broader startup ecosystem in the Waterloo Region

“Attracting financial support early on is the key to long-term success for deep tech startups in particular,” said Adrien Cote, executive director of Waterloo’s Velocity incubator. “We’ve seen this time and time again with our companies. It’s great to have this fund administered locally, by people who have a real sense of the talent in our region and therefore, the expertise to make smart and strategic investments to set both investors and our companies up for success.”

To learn more about how Waterloo and Velocity support entrepreneurs, please visit the website.

This document is not an offer to issue or sell, or a solicitation of an offer to subscribe for or buy, any securities or other financial instruments, nor does it constitute a financial promotion, investment advice or an inducement to purchase any product, or to participate in any offering or investment. Any offer to purchase or buy securities will only be made to qualified investors, and only pursuant to an offering document and subscription documents furnished to such qualified investors on a confidential basis.

Read more

Upside Robotics secures new funding to accelerate the future of sustainable farming

Read more

Many Hearts, One Mind by Indigenous artist Alanah Jewell celebrates the act of creation shared by the Land and innovators in our community

Read more

New Zealand adopts researcher-centric principles after studying Waterloo’s pioneering approach to IP ownership

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg, and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations.