Planning for retirement in uncertain financial times

How the current economy will impact people’s savings and retirement plans

How the current economy will impact people’s savings and retirement plans

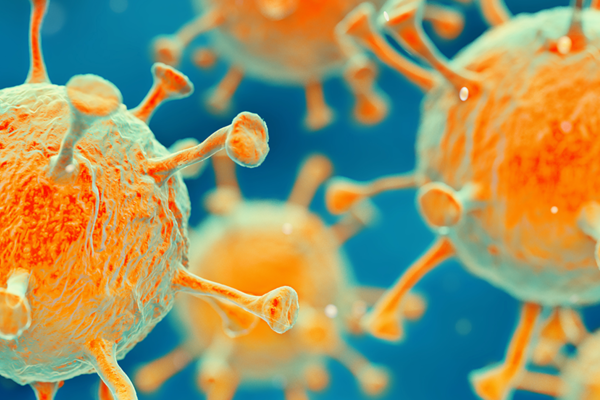

By Angelica Sanchez University RelationsThe economic impact of COVID-19 continues to be a global issue for people and businesses everywhere. Many in our community are wondering how the shutdown of our economy will affect their long-term financial goals.

James Thompson is a Waterloo professor in the School of Accounting and Finance. On Wednesday, May 27, he joined us for this week’s Ask our Experts community talk to discuss retirement planning in the time of COVID-19, as well as answer your questions about personal finance.

“It’s not a good environment to be saving,” Thompson says. The problem is that many people don’t have a lot of extra money sitting around because people have lost their jobs or are currently working with their hours cut back. “I think it’s important we understand why we’re not saving as much … and convince ourselves it’s worthwhile.”

Thompson explains that we cannot predict what’s going to happen with the stock market during these unprecedented times. Although the market seems to be going up today, he believes there’s nothing to say that the market won’t go straight back down tomorrow.

“The time to put your money in a secure place is before the crash. After the crash is not your ideal time,” Thompson says. “I would say if you can, this is when you should add to your [savings] ... the key thing is as long as you’re to hold them long-term.”

Thompson says there are savings options available for working Canadians. He recommends to individuals who are in the position of being able to save money is to have a Tax-Free Savings Account (TFSA). TFSA is a flexible option where it allows people to put their after-tax income into the account and don’t have to pay any taxes when it’s time to take the money out.

Thompson adds, “With younger people, TFSA is preferred because you’re free to take money out when you want and will just have to wait until the next year to put the money back in.”

Many community members of all ages are wondering about their financial stability during these uncertain times, and Thompson offers a few recommendations.

People at the start of their career

Thompson says people should be prepared for the future because the issues of recession have not been solved and will continue to happen. He recommends creating a budget for people to keep track of their cash inflows and outflows at this time.

Along with his advice on using a TFSA, Thompson explains Group Registered Retired Savings Plans are a great option to save for retirement.

“It gives your employer a chance to contribute,” Thompson says. “There are no other investments where you can make money risk free like that.”

Soon to be and current retirees

Thompson explains that it is ideal if current retirees don’t sell their assets if they have been devalued. He says, “If you can hold off … lower your withdrawal from your income fund.”

“But if not, you’re in the best position to start selling assets that have been depleting the least,” Thompson says. “You can sell assets like your bonds.”

Here are some resources Thompson recommends for learning more about financial planning:

Next week, our Waterloo expert will be James Danckert, a professor in the Department of Psychology. There’s a finite amount of binge-watching that people can tolerate. While many of us are at home, what are other things we can do to pass time?

On Wednesday, June 3 at noon, Danckert will share his work about the boredom people experienced during SARS and answer your questions about what to do with your time while you’re waiting for stay-at-home orders to be lifted.

Read more

How to use social media effectively during a pandemic and spotting fake news stories about COVID-19

Read more

How a new COVID-19 screening tool can be used to identify older adults at risk

Read more

How to manage stress and anxiety during the COVID-19 pandemic

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg, and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations.