Life expectancy and insurance

People are living longer than ever, which means insurance companies and pensions face bigger payouts. Waterloo actuarial scientists are helping them cope.

People are living longer than ever, which means insurance companies and pensions face bigger payouts. Waterloo actuarial scientists are helping them cope.

By Staff Communications & Public Affairs One of the most radical shifts in the last century is how much longer people are living. Life expectancy has been steadily rising for as long as there’s been reliable data, which for Canada means since the 1920s. In most senses, that’s a good thing.

One of the most radical shifts in the last century is how much longer people are living. Life expectancy has been steadily rising for as long as there’s been reliable data, which for Canada means since the 1920s. In most senses, that’s a good thing.

But increased life expectancy is a challenge for financial institutions, because when people live longer than expected, they get more pension and health insurance payouts and, in some cases, life insurance payouts. That means increased liability for insurance companies and pension plans.

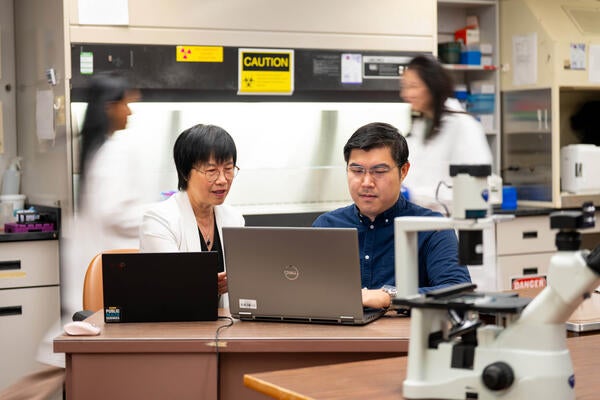

Luckily for financial services companies, Fairfax Chair and associate professor Johnny Li of Waterloo’s actuarial science department is figuring out how to deal with that issue.

In the past, when insurance companies sold people policies, they underestimated how much more longevity could improve. Even a slight underestimation can have a big impact, says Li.

“If you manage a pension plan and you have, say, 10,000 retirees, and every year you have to pay a pension of, say, $20,000 per retiree... if people are living one year longer than expected, your plan has to pay $200 million additionally,” says Li, who holds the Fairfax Chair in Risk Management.

“Twenty years ago, people expected human longevity to stop improving at some point in time or at least slow down. But it turns out it hasn’t.”

Li and his colleagues are working to create awareness about longevity risk. “It’s important for the industry to understand that this risk is real, and it’s coming,” says Ken Seng Tan, Li’s former PhD supervisor.

One way companies are coping is by passing off some of the risk to reinsurance companies. Another newer method is trading securities that will pay more if people live longer than expected and less if the opposite occurs.

Says Li: “though it’s still hard to predict how long people will live in the future, methods such as these should help people’s pension and insurance plans to survive in an increasingly long-lived world.”

Read more

How machine learning empowers collaboration between computer science, math and medical research

Read more

Here are the people and events behind some of this year’s most compelling Waterloo stories

Read more

Meet five exceptional Waterloo graduate students crossing the convocation stage as Class of 2025 valedictorians

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg, and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations.