Planning for a financial rainy day

Despite worldwide economic turmoil, Canada’s financial institutions have been more stable than most. Waterloo actuarial scientists helped make them that way.

Despite worldwide economic turmoil, Canada’s financial institutions have been more stable than most. Waterloo actuarial scientists helped make them that way.

By Staff Communications & Public Affairs Mary Hardy isn’t risk-averse in every way. She used to drive a motorcycle. In 1997, she moved from Scotland to Canada to marry fellow actuary and professor Phelim Boyle, whom she met while on sabbatical at the University of Waterloo.

Mary Hardy isn’t risk-averse in every way. She used to drive a motorcycle. In 1997, she moved from Scotland to Canada to marry fellow actuary and professor Phelim Boyle, whom she met while on sabbatical at the University of Waterloo.

But the actuarial science professor is not only a conservative investor personally; she has made a career of urging financial institutions to play it safe. Her advice helped Canada’s financial industry make it through the financial crisis of 2008 in relatively good shape.

Traditional risk can be managed by diversifying investments. But financial risk is different, says Hardy, who is CIBC chair in financial risk management. With stocks, “when one tanks, they probably all tank.”

Financial risk is managed through a principle called replication, explains Hardy. “If I have a liability, it means that when stocks fall, I owe money. If I can invest in something that pays money when stocks fall, I can replicate that liability.”

Problem is, financial institutions don’t always apply replication models properly — for instance, bankers might not set aside the money they’d have to pay out if markets tank.

Most of the time, the risks pay off and the bankers earn big bonuses. But when markets behave abnormally, financial institutions can fail, as some did in 2008-2009.

“They didn’t buy insurance and then the house caught fire,” says Hardy.

Canadian financial institutions weathered the financial crisis better than American ones, in part because of the work of a task force Hardy was involved in a decade ago.

Insurance companies in particular didn’t want to put aside as much money for liability as the task force recommended, but the Canadian regulator of banks and insurance sided with the task force. It turned out to be the right call, says Hardy.

“Insurers are hurting a little bit, but if the regulator hadn’t insisted 10 years ago on a big cushion of assets, things would be worse.”

Read more

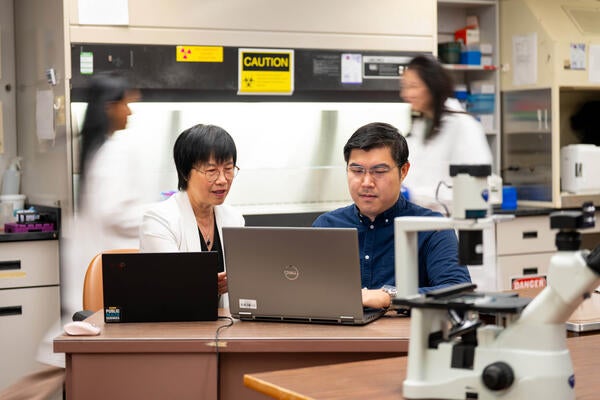

How machine learning empowers collaboration between computer science, math and medical research

Read more

Here are the people and events behind some of this year’s most compelling Waterloo stories

Read more

Meet five exceptional Waterloo graduate students crossing the convocation stage as Class of 2025 valedictorians

The University of Waterloo acknowledges that much of our work takes place on the traditional territory of the Neutral, Anishinaabeg, and Haudenosaunee peoples. Our main campus is situated on the Haldimand Tract, the land granted to the Six Nations that includes six miles on each side of the Grand River. Our active work toward reconciliation takes place across our campuses through research, learning, teaching, and community building, and is co-ordinated within the Office of Indigenous Relations.