The University acknowledges that within its stewardship of University and Pension investments, it has a fiduciary duty to act reasonably and prudently. As a result, the University integrates environmental, social and governance (‘ESG’) factors into investment decision based on the belief that this approach is expected to enhance the long-term value of investment performance and reduce the risk of loss.

For more information please refer to the University’s ESG Principles and Guidelines and Responsible Investment Policy.

UNITED NATIONS’ PRINCIPLES FOR RESPONSIBLE INVESTMENT

The United Nations’ Principles for Responsible Investment (‘UNPRI’) is the world’s leading proponent of responsible investment (‘RI’).

The University signed its declaration to the United Nation’s Principles for Responsible Investing (UN PRI) on February 13, 2020, confirming its commitment to responsible investing, and was accepted as an official signatory on May 11, 2020.

As a separate legal entity, the University of Waterloo Pension Plan for Faculty and Staff applied to the UN PRI separately and was registered as a signatory to the UN PRI on June 2, 2020.

As part of this commitment, the University is required to complete annual reporting on our responsible investment activities, leading to transparency reports available through the UN PRI website for both the University and for the Pension Plan.

RESPONSIBLE INVESTMENT CHARTER FOR CANADIAN UNIVERSITIES

By leveraging their assets, universities can devise comprehensive strategies to address climate change. As educators, our teaching has the power to enhance understanding of the principles of sustainability. As knowledge producers across a wide range of disciplines, our research is essential in advancing knowledge about climate change and helping identify effective, evidence-based solutions. As major owners of property and facilities, we have an important opportunity to reduce the carbon emissions arising from our own operations. And, as stewards of long-term investments, we have a responsibility to manage our capital in ways that accelerate the transition to a low-carbon economy and protect our stakeholders from the growing risks associated with climate change.

With these considerations in mind, the University is a signatory to the Responsible Investment Charter for Canadian Universities. By signing this charter, the University has committed to:

- Adopting a responsible investing framework to guide decision-making, in line with recognized standards such as the UN-supported Principles of Responsible Investment

- Regularly measure the carbon intensity of our investment portfolios and set meaningful targets for their reduction over time

- Evaluate progress towards these objectives on a regular basis and share the results of such assessments publicly

- Ensure that the performance evaluation of our investment managers takes into account their success in achieving such objectives, alongside the other criteria for assessing their performance

CARBON REDUCTION STRATEGY

The science of climate change is irrefutable. Increased concentrations of greenhouse gas emissions in the atmosphere continue to increase global temperatures to levels that elevate risks for humanity, the environment and all living creatures. As a science-based institution, the University of Waterloo acknowledges the grave realities of a warming planet. As a publicly funded educational institution, the University of Waterloo also recognizes its responsibility to contribute to climate change mitigation to allow past, present and future students to live in a sustainable and habitable world. As a fiduciary responsible for the investment of endowment and pension funds, the University of Waterloo has a duty to manage the financial risks and opportunities associated with climate change in its investment portfolios.

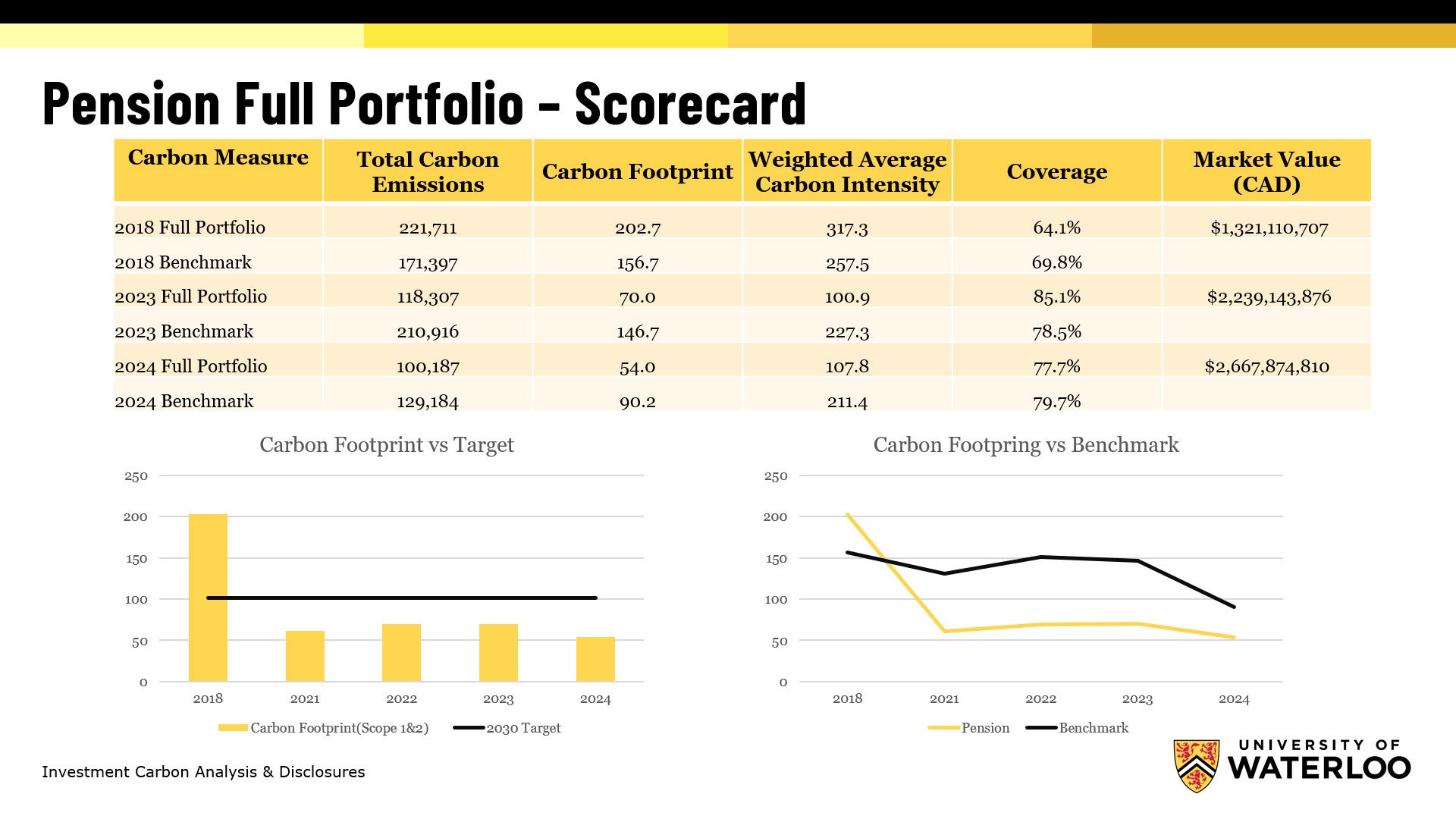

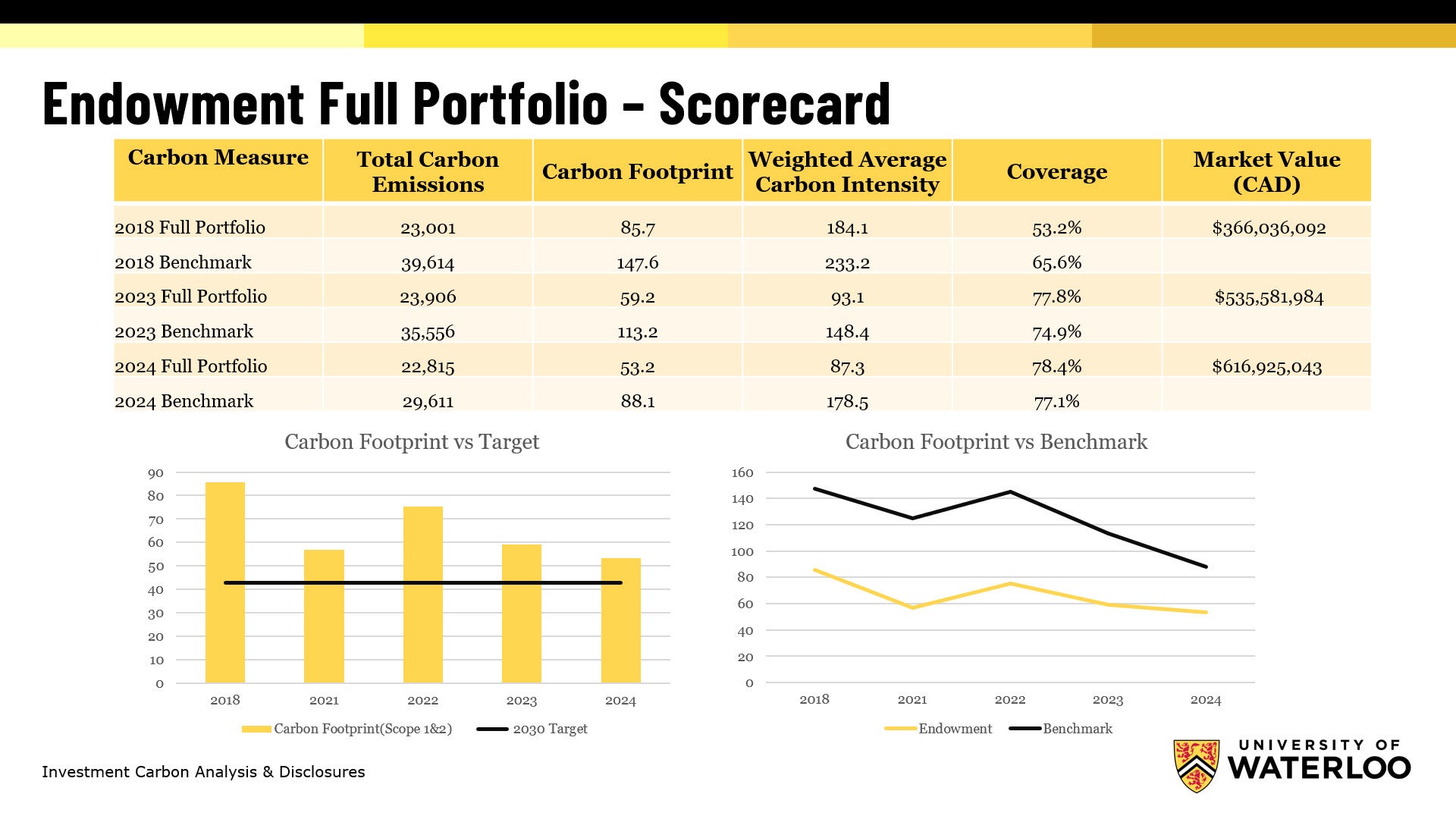

To this end, the Board of Governors for the University of Waterloo has endorsed the following targets and aspirational goals for both the Endowment Fund and the Pension Plan:

- Reduce the carbon footprint (Scope 1 & 2) of the Endowment and Pension Funds’ investments, by at least 50% by 2030, relative December 31, 2018, and

- Set an aspirational goal of achieving a net-neutral carbon footprint for Endowment and Pension Fund investments by 2040.

Carbon Measurements include all asset classes within the investment portfolio, which includes equity, fixed income and real asset classes.

Carbon Measurements

- Total Carbon Emissions = The absolute greenhouse gas emissions associated with a portfolio, expressed in tons CO2e.

- Carbon Footprint = Total carbon emissions for a portfolio, normalized by the market value of the portfolio, expressed in tons CO2e / $M USD invested.

- Weighted Average Carbon Intensity = The portfolio’s exposure to carbon-intensive companies, expressed in tons CO2e / $M USD revenue.

FOSSIL FUEL INVESTMENTS

As part of its UN PRI commitments, and in conjunction with its carbon reduction strategy, the Board of Governors has endorsed commitments related to energy sector holdings and reporting within its active equity portfolio to include:

- That any material direct investments in fossil fuel companies be avoided

- It is expected that with ESG integration and the phased carbon exposure reduction strategy, the University’s active equity managers will not hold any material positions in fossil fuel exploration and extraction companies by 2025

Task Force on Social Responsibility in Investing

In February 2025, the Task Force on Social Responsibility in Investing issued its report containing recommendations based on its consideration of the Responsible Investment Policy and related policy framework, with a lens on social factors related to the University’s Pension and Endowment investment mandates.

The Task Force report outlined the following recommendations.

1. Investment disclosure practices

Disclose all investment holdings annually, including the percentage of each holding of the endowment’s or pension’s total market value and provide context about the investment approach and fiduciary responsibilities.

2. Priority social factors

Update the Responsible Investment Policy to include as priority social factors, international human rights, including anti-oppression, anti-racism, indigenous reconciliation, equity and diversity, and adherence to the UN’s convention on certain conventional weapons.

Request and monitor reporting from investment managers on their incorporation of these social factors into their investment decision-making.

3. Feedback process

Establish a policy to proactively collect and review stakeholder feedback related to endowment investments every three years, including a feedback loop with stakeholders on the feedback received and how it has been considered and used.

4. Policy updates

Revise the Responsible Investment Policy to reflect the new priority social factors, expand reporting requirements, and formalize the proactive feedback approach.

The status of the implementation plan to address the Task Force recommendations is as follows:

1. Investment disclosures have been made available and expanded information on the Investments web page provides further information on the University’s investment approach.

2. Updates to the Responsible Investment Policy to address the task force recommendations will be available for review and discussion in Fall 2025, including at the October 2025 Board meeting, with a goal of having the updated Policy approved in February 2026.

The University is discussing the task force recommendations with its investment managers and is investigating possible reporting options and data points. The Responsible Investment Policy is reviewed annually, and the University intends to recommend further updates to this policy over time as reporting expectations and capabilities are developed.

3. Once reporting capabilities have been established and social factor reporting made available to the campus community, the University is committed to establishing an appropriate social factor review and feedback process.

Such a process is likely to be developed by combining feedback efforts on environmental and governance factors as well.

INVESTMENT MANAGERS AND FUNDS

The University’s specific investment approach varies by mandate; however, the general principles focus on long-term value creation. This approach is executed through the rigorous selection of investment managers offering institutional pooled funds which are considered leaders in ESG and responsible investment integration. In addition to monitoring each investment manager’s investment performance and market outlook, each investment manager is monitored to ensure consistency of style/approach including their ESG factor integration strategies and, reviewing the consistency of their proxy voting actions with their policy statement. The University engages with each investment manager on ESG matters and expects the managers to do the same with the companies they invest in, reporting on such engagements and how it supports the manager’s duty to act in the best interest of the University’s investment.

The University recognizes, however, that managers may consider ESG factors in different ways when assessing whether a given investment will have the best economic outcome. In order to protect and enhance the University’s investments, when selecting investment managers or direct investments, in addition to ESG factors, the University considers criteria that include the manager’s business and staff and historical performance.

Most of the University’s investment managers are signatories to UN PRI. Links are provided below for publicly available information on these investment managers’ responsible investment activities:

|

Investment Manager |

RI/ESG Info |

|---|---|

|

CBRE Investment Management |

|

|

Fiera Capital |

|

|

IFM Investors |

|

|

Northleaf Capital |

|

|

PH&N Investment Services (a division of RBC Global Asset Management) |

|

|

Sound Point Capital |

|

|

TD Global Investment Solutions (TD Asset Management) |

|

|

Walter Scott & Partners |

The University has investments into funds managed by the following venture capital investment managers. While these investment managers are not currently signatories to the UN PRI, the University engages with them on ESG issues per the Responsible Investment Policy. In addition to the financial opportunity these managers and funds provide, they also offer unique, synergistic alignments in their support of the local venture capital/start up ecosystem.

- Garage Capital

- True North Fund

- Velocity Fund