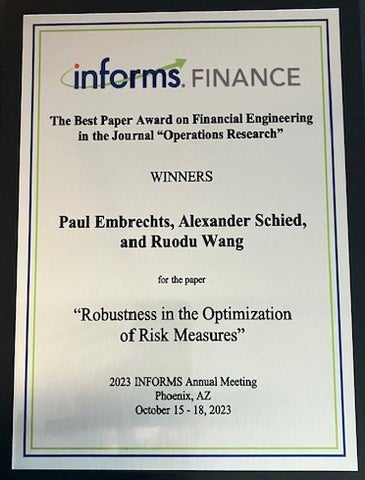

The Institute for Operations Research and the Management Sciences (INFORMS) has awarded department members Alexander Schied and Ruodu Wang, along with co-author Paul Embrechts (ETH Zurich) the Best Paper Award on Financial Engineering in the journal "Operations Research".

The paper aims to understand the consequences of risk optimization in finance when the model being used is uncertain or wrong. The conclusion is that some classic methods of risk assessment, called risk measures in the scientific field, are problematic, and some new methods in financial regulation are much better.

For this purpose, the authors study issues of robustness in the context of Quantitative Risk Management and Optimization. They develop a general methodology for determining whether a given risk-measurement-related optimization problem is robust, called “robustness against optimization.” The new notion is studied for various classes of risk measures and expected utility and loss functions. Motivated by practical issues from financial regulation, special attention is given to the two most widely used risk measures in the industry, Value-at-Risk (VaR) and Expected Shortfall (ES). The authors establish that for a class of general optimization problems, VaR leads to nonrobust optimizers, whereas convex risk measures generally lead to robust ones. The results offer extra insight on the ongoing discussion about the comparative advantages of VaR and ES in banking and insurance regulation. The new notion of robustness is conceptually different from the field of robust optimization, to which some interesting links are derived.