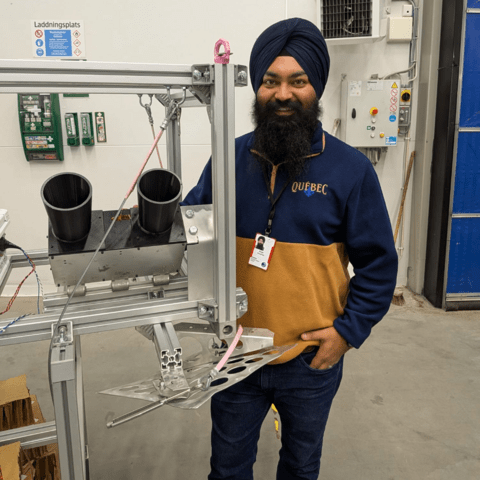

Congratulations to Gurpreet Singh for their work on environmental impacts of space activity

In recent news, Gurpreet Singh, a PhD Candidate in Sustainability Management, was featured for their work on the environmental impacts of space activity.

The number of satellites within Earth’s orbit has greatly increased since 2020, which has led to better broadband connectivity and enhanced Earth observation capabilities. However, this rapid expansion of satellites brings challenges over increased light pollution, increased radio frequency interference, disruptions to circadian rhythms and disruptions to traditional celestial navigation systems.