Thursday, July 2, 2020

A group of SEED graduate students used their time during COVID to collaborate on COVID-related research. Zachary Folger-Laronde, Sep Pashang, Leah Feor and Amr ElAlfy conducted research on the question, whether there are differences in the financial performance of responsible investments (RI) vs conventional investments during the COVID-19 pandemic. With the advent of the COVID-19 pandemic, the world has experienced economic and social fragility, which calls for alternative approaches to navigate towards sustainable outcomes.

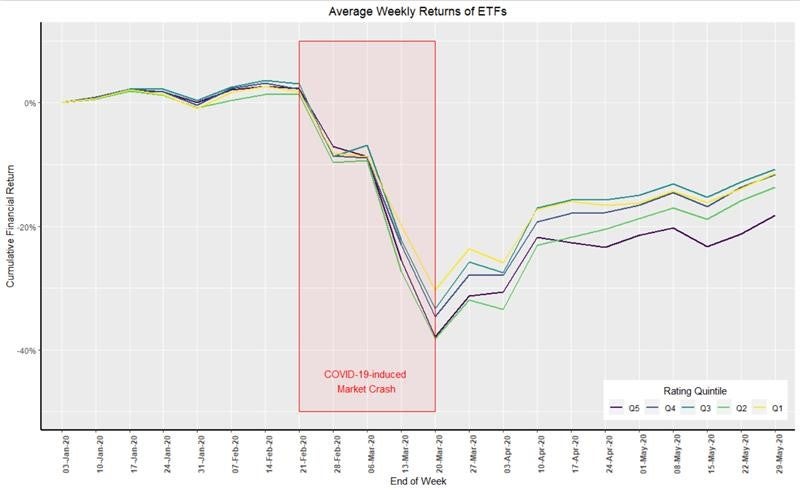

While recent studies show that responsible investments (RI) are resilient during the economic downturn caused by crises such as COVID-19, there has been little exploration into exchange-traded funds (ETFs). Using ANOVA and multivariate regression models, the authors analyze the differences and relationship between the financial returns of ETFs and their Eco-fund ratings during the COVID-19 pandemic-related financial market crash. The results indicate that higher levels of the sustainability performance of ETFs do not safeguard investments from financial losses during a severe market downturn (see the figure).

These results contribute to the research by exposing weaknesses of current sustainability scores and rating methods to provide an initial analysis of RI during the COVID-19 pandemic.

The paper has been published in the Journal of Sustainable Finance & Investment and is available here.