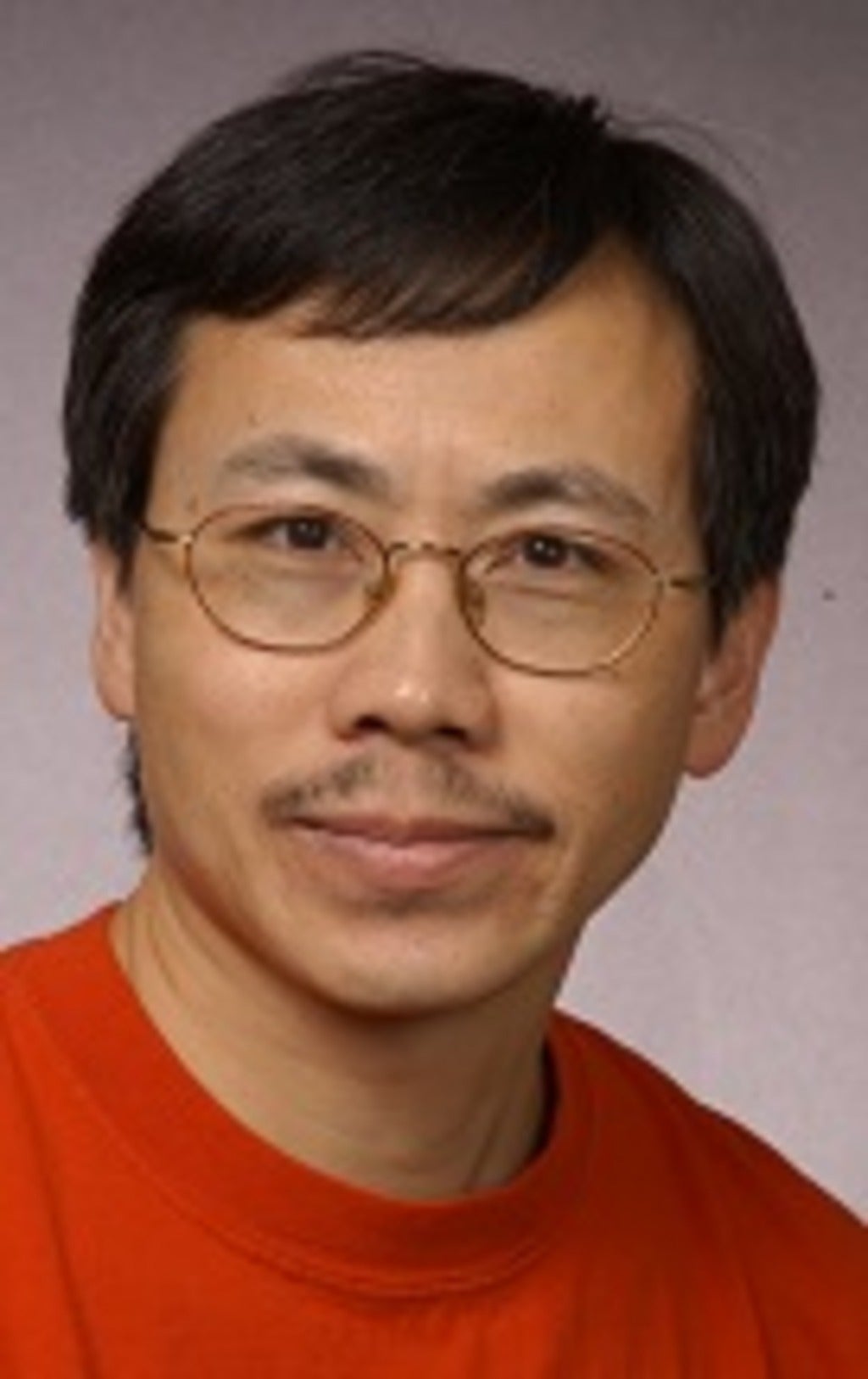

Changbao Wu Named Fellow of IMS

Changbao Wu, Professor of Statistics in the Department of Statistics and Actuarial Science at University of Waterloo, has been named Fellow of the Institute of Mathematical Statistics (IMS).

Dr. Wu is honored with the fellowship for his “important and original research contributions to survey sampling theory and official statistics, especially for the development of model-calibration theory and techniques, empirical likelihood methods for complex surveys, and robust inferential procedures for analyzing non-probability samples”.

Founded in 1935, the IMS is one of the world’s premier societies in statistics and probability. Each Fellow nominee is assessed by a committee of their peers and the election is based on “demonstrated distinction in research in statistics or probability, by publication of independent work of merit”. This qualification may be partly or wholly waived in the case of either a candidate of well-established leadership whose contribution to the field of statistics or probability other than original research shall be judged of equal value; or a candidate of well-established leadership in the application of statistics or probability, whose work has contributed greatly to the utility of and the appreciation of these areas.

The list of the 2021 class of IMS Fellows can be found at the IMS website.