Investing in longevity of research

Longevity risk is an essential concept for life insurance companies and reinsurance companies. A deep understanding of the risk is crucial, as an underestimation of longevity can seriously affect the financial healthiness of pension plans and annuity funds.

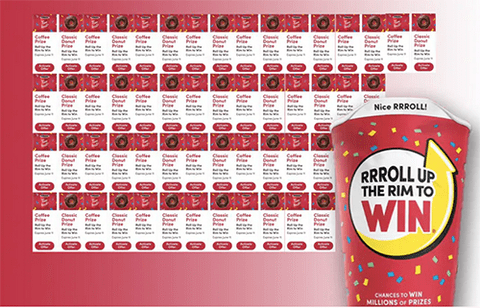

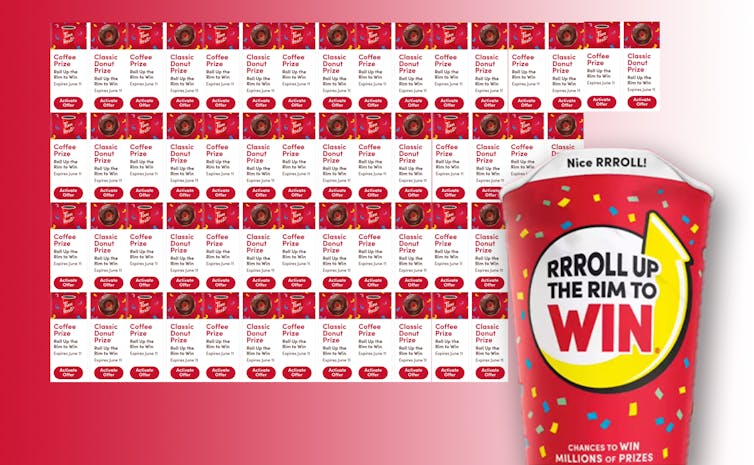

A statistics professor used his expertise in calculating probabilities to come up with a 98 winning percentage for Tim Hortons popular Roll up the Rim contest.

A statistics professor used his expertise in calculating probabilities to come up with a 98 winning percentage for Tim Hortons popular Roll up the Rim contest.