From Dock to Data: Reflections on VCIC 2025

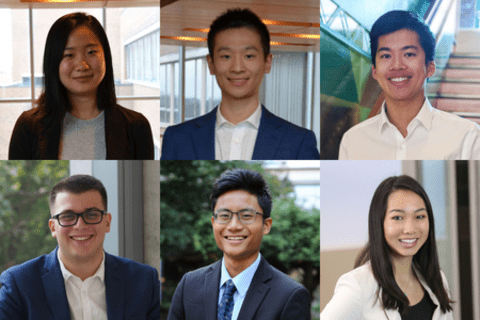

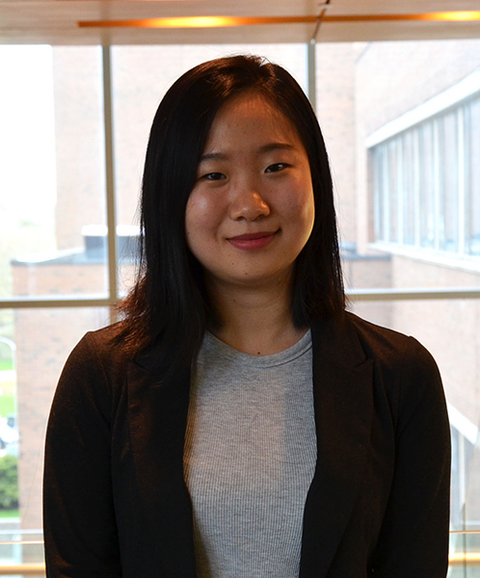

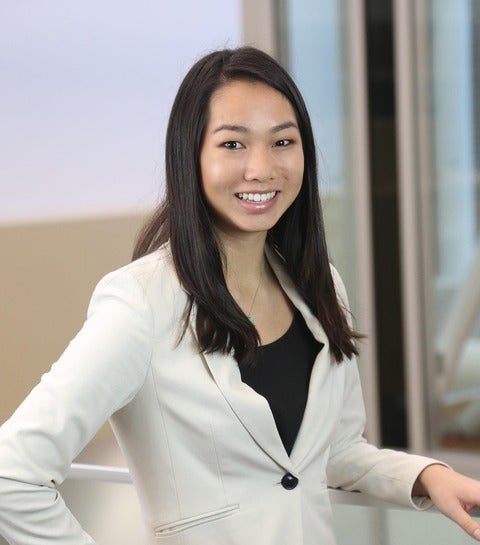

Over reading week, Alex, Anthony, Nancy, Sarah, and Vivian, graduate students from the School of Accounting and Finance (SAF), had the privilege of representing the University of Waterloo at the Canadian MBA/Graduate Finals of the Venture Capital Investment Competition (VCIC) in Halifax.