Waterloo professor recognized for excellence in service

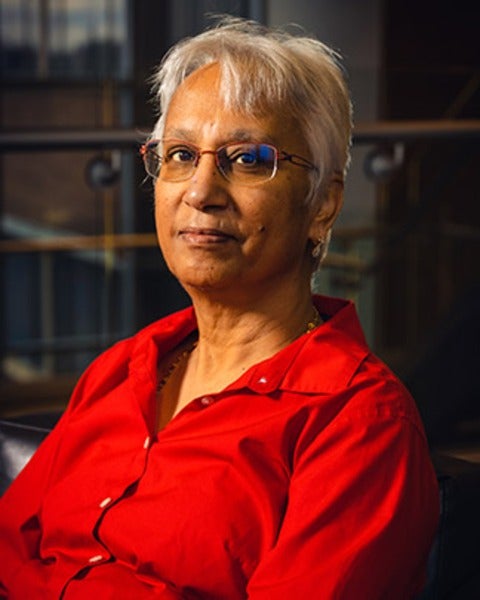

Congratulations to School of Accounting and Finance professor Ranjini Jha, recipient of the 2023 Arts Award for Excellence in Service!

Established in 2012 by then-dean Doug Peers, the Arts Awards for Excellence in Service, Teaching and Research recognize exceptional contributions made by faculty, staff, and students in the Faculty of Arts. This is the 11th anniversary of the Arts Awards and more than 30 members of the Arts community were nominated by their chairs, supervisors, and colleagues.