Dr. Alec Cram awarded $223K in National Cybersecurity Consortium funding for human-centric cybersecurity research project

Dr. Alec Cram from the School of Accounting and Finance has received $223,529 in funding from the National Cybersecurity Consortium (NCC) to lead a three-year research project on how employee attention impacts cybersecurity behaviour.

This project is part of NCC’s initiative to strengthen Canada’s cybersecurity ecosystem.

How carbon pricing influences behaviour in the housing market

SAF professor Dr. Tingting Wu shares research showing the effect of carbon pricing on the behaviour of home buyers and sellers — shaping their awareness, attitudes and decision-making in the real estate market.

How SAF is evolving as automation reshapes the audit profession

SAF professor Dr. Krista Fiolleau co-leads a new study revealing how automation is reshaping the role of junior auditors.

Greenwashing or genuine? How investors and the public can tell the difference

As Earth Day prompts reflection on sustainability, Dr. Elizabeth Demers, professor at the School of Accounting and Finance, helps unpack the complexities of greenwashing in corporate reporting in this insightful Q&A. From new legislation to misleading ESG scores, learn why spotting the difference between real and performative environmental action is more important—and more complicated—than ever.

Dr. Ken Vetzal receives international recognition for pension research

The School of Accounting and Finance congratulates Professor Emeritus Ken Vetzal on receiving the 2024 Chris Daykin Prize from the International Actuarial Association.

Dr. James Thompson explains the key differences in U.S. and Canadian banking

Recent rhetoric has emerged alleging that U.S. banks aren’t allowed to do business in Canada, which is untrue. U.S. banks have been operating in Canada for well over a century with 16 U.S.-based bank subsidiaries and branches managing $113 billion in assets here in the country.

James Thompson, SAF professor and co-director of the Computing and Financial Management program, breaks down how U.S. banks operate in Canada—challenging misconceptions and offering key insights on cross-border banking.

Investors are more likely to opt for green labels over financial returns — fueling greenwashing concerns

Researcher from the School of Accounting and Finance cautions that clear regulatory oversight is needed to protect investors.

The topic of sustainability is becoming increasingly popular in the investment world with sustainable investing creating a large global impact. This significant shift lead the School of Accounting and Finance's (SAF) Dr. Adam Vitalis and his co-authors to research how green labels attract investors to certain projects which can open the door to greenwashing.

Teams with diverse expertise produce innovative ideas, but are they practical?

Dr. Adam Presslee explores the challenges of turning creative ideas into workable solutions.

Collaborating with researchers from Xiamen University and Texas Tech University, his recent study examines how teams with different skill sets generate and refine ideas using advanced neuroimaging technology.

Jillian Adams (PhD ’24): A trailblazer in accounting and valedictorian for the Faculty of Arts

SAF PhD student Jillian Adams is recognized for her achievements as the 2024 Faculty of Arts valedictorian.

Paying fairly: Insights from new study on tax fraud prevention

New research by the Waterloo's School of Accounting and Finance explores how penalty severity and social norms impact tax compliance, especially in the context of COVID-19 relief fraud.

Dr. Adam Presslee wins Arts Award for excellence in research

SAF Professor is being recognized for his contributions to accounting research.

Three SAF professors earn Distinguished Emeriti recognition for longstanding service

Three SAF professors will receive the Distinguished Professor Emeriti award in 2024.

Fairer reward systems and improved team dynamics: Key insights from new research

A recent study conducted by researchers from the University of Waterloo and Wilfrid Laurier University offers crucial insights into creating fairer employee reward systems and enhancing team dynamics.

SAF Professor Kelsey Matthews, a co-author of the study, emphasizes the importance of mandatory explanations to mitigate self-interested biases among team members, particularly those with lower abilities.

Tisha King, SAF Researcher, helps discover Canada’s trailblazing Black accountants

Dr. Tisha King, professor at Waterloo’s School of Accounting and Finance, collaborated on a research project to find and pay homage to Canada’s first Black accounting professionals in honour of Black History Month.

Do terrorist attacks and mass shootings make big companies more “honest”?

Terrorist attacks and mass shootings are devastating for the people and communities they affect. These events impact our society in many ways, including perhaps unexpectedly, by changing how big companies calculate and report their earnings.

A recent study by Professor Seda Oz from the School of Accounting and Finance at the University of Waterloo explains why.

The Psychology of Success in Data Science Contest Design

Researcher from the School of Accounting and Finance explores how nonmonetary factors impact contestant behavior and effort levels

How businesses recognize employee achievement impacts engagement, motivation and performance

New research shows that team-based recognition can be effective in settings where performance is highly interdependent, and teamwork is essential to the company’s success.

Is algorithm control a double-edged sword? Uber drivers’ positive and negative techno-stressors

How brands address getting called out on Twitter affects their bottom line, a new study finds

In the digital age, a new Twitter strategy can have implications for a healthy bottom line. How companies handle customer complaints on social media plays a critical role in their customer-focused performance management systems. However, there has been a notable lack of descriptive information related to assessing managerial performance based on the handling of online complaints.

New proxies for expected duration of competitive advantage

Based on the emerging technology, this paper proposes a new method to measure the expected duration of competitive advantage for average adopters. This method is based on public data, such as google searches, press releases, book titles, and companies’ disclosures with respect to the technology. The method is very easy to implement.

Waterloo professor recognized for excellence in service

Congratulations to School of Accounting and Finance professor Ranjini Jha, recipient of the 2023 Arts Award for Excellence in Service!

Established in 2012 by then-dean Doug Peers, the Arts Awards for Excellence in Service, Teaching and Research recognize exceptional contributions made by faculty, staff, and students in the Faculty of Arts. This is the 11th anniversary of the Arts Awards and more than 30 members of the Arts community were nominated by their chairs, supervisors, and colleagues.

Congratulations to SAF professor Ranjini Jha, recipient of a 2023 Arts Award

More than 30 nominations submitted for the 2023 Arts Awards for Excellence in Service, Teaching, and Research posed an especially tough challenge for members of the Arts Honours and Awards (AHA) committee this spring. So many outstanding members of the Arts community inspired their chairs, supervisors, and colleagues to put names forward as nominees to recognize their contributions and achievements. Today, Dean Sheila Ager and the AHA committee are happy to share the results.

Waterloo professor recognized for best paper by the Canadian Academic Accounting Association

Wenqian Hu’s paper Trust Versus Rewards: Revisiting Managerial Discretion in Incomplete Contracts was awarded the Lazaridis Institute Prize for the best paper on accounting issues relevant to technology firms. The paper finds that an algorithm-generated bonus allocation scheme improves employee productivity, compared with human managers’ bonus allocation.

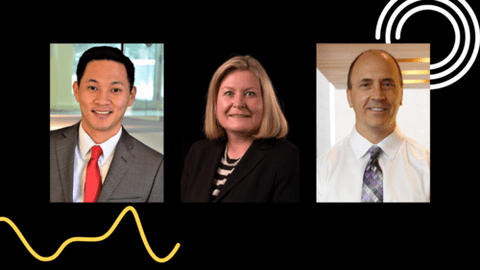

2022 Outstanding Performance Award recipients named

Recipients of the 2022 Outstanding Performance Award have been named and include three School of Accounting and Finance faculty members: David Ha, Deborah Kraft and Daniel Rogozynski.

Employers should think twice before implementing peer recognition programs

In fast-paced and often rapidly changing work environments, employers continue to seek new and improved ways to recognize employees in the workplace. However, new research from the University of Waterloo suggests that public peer recognition may backfire by enabling comparisons among employees, and these comparisons may make some employees feel unfairly treated.

Waterloo professor distills responsibility of accountants faced with suspected regulation non-compliance

Krista Fiolleau, associate professor in the School of Accounting and Finance (SAF) has recently published a chapter titled “The professional responsibility of accountants as re-defined by the inclusion of the NOCLAR standard in the Code of Ethics” within the Research Handbook on Accounting Ethics alongside co-authors Pier-Luc Nappert from Université Laval and Linda Thorne from the Schulich School of Business. NOCLAR, an acronym meaning non-compliance with laws and regulations is discussed extensively throughout the chapter.

Meet the 2023 Immigration Women of Inspiration recipients

From becoming the first member of her family to graduate from university, Ranjini Jha now educates other students as a professor of finance at the University of Waterloo.

Mingyue Zhang - Assistant Professor

Mingyue Zhang is an assistant professor of accounting at the School of Accounting and Finance at the University of Waterloo.

She earned her PhD in Accounting from the University of Toronto (Rotman School of Management) and Master of Professional Accounting from Singapore Management University. She is also an affiliate of the Association of Chartered Certified Accountants.(ACCA)

Waterloo professor inducted to the Canadian Accounting Hall of Fame

by Alyana Versolatto

The School of Accounting and Finance (SAF) is pleased to share that professor Efrim Boritz was inducted this year into the Canadian Accounting Hall of Fame for his extraordinary contributions to the accounting profession. During Boritz’s illustrious 40-year career at the University of Waterloo, he has been a prolific writer and researcher with 24 books and monographs to his credit and over 40 articles in refereed journals. His research involves investigating areas of professional practice in external auditing and internal auditing which rely on the exercise of professional judgment.

Safeguarding against phishing emails

Cyber-attacks and data breaches are of great concern for data-sensitive organizations. These organizations are adept at safeguarding data but fail in safeguarding against cyber-attacks. Phishing is a semantic attack that deceives email users into clicking on the embedded link or attachment in an email. The goal could be to induce the email users to subsequently give away sensitive information, enable malware that can steal passwords, or install a backdoor into the user’s system and encrypt the users’ data. Phishing imposes a great risk on these organizations for two reasons. First, even a non-vital position in which employees likely perceive little cyber risk, if being attacked, could cause significant economic loss and litigations. Second, phishing emails could simultaneously reach most employees within an organization. Thus, strengthening the frontier of safeguarding against phishing is of vital importance.

Higher employee performance with charitable donation rewards instead of cash rewards

As workplace practices continue to shift, organizations are finding inventive ways to keep their employees motivated and committed to reaching their goals.

Q and A with the experts: The banking crisis and Canada

The recent collapse of banks in the United States and this week's intervention by the Swiss government to facilitate the takeover of banking giant Credit Suisse might have some worried about a repeat of the 2008 financial crisis.

Dr. James R. Thompson, associate professor in the School of Accounting and Finance and co-director of the University of Waterloo's Computing and Financial Management program, sheds light on what's causing the instability in the banking system and how it might affect Canadian financial institutions.

Banking crisis echoes 2008 but with ‘marked differences’

Many fear a repeat of 2008 given the recent collapse of banks in the United States and the intervention that happened this week by the Swiss government to facilitate the takeover of banking giant Credit Suisse.

Muhammad Azim, Assistant Professor

Muhammad Azim is an Assistant Professor at the School of Accounting and Finance at the University of Waterloo.

He acquired his Bachelor of Commerce from Queen's University, Masters in Finance from Queen's University, and a PhD in Accounting from the University of Toronto. He has previously worked at Deloitte's Assurance and Advisory Services, and during that time he also obtained his CPA and CA degrees.

Tisha King, Assistant Professor

Tisha King is a professional accountant and earned her Ph.D. from Wilfrid Laurier University. Professor King specializes in behavioral research that largely focuses on ethical judgments and decision-making within the context of taxpayers and tax professionals. Her recent studies investigate how advances in technology, penalties, and fairness influence tax compliance. In her free time, Professor King enjoys running, biking, and hiking with her family.

New year, new taxes: how taxation changes in 2023 could affect you

The federal government has introduced several changes to taxation and tax benefits for this year — and experts tell CBC News the tax changes related to housing are the ones to watch.

The federal government indexes personal income tax brackets and many tax benefits to inflation. They'll increase by 6.3 per cent this year, says the Canada Revenue Agency.

Daily movie theatre ticket sales can predict stock market returns

Daily box office earnings can accurately predict stock market returns, according to a new study.

Traditionally quarterly and monthly consumption data is used to predict stock market performance. But using box office earnings – a measure that captures consumption on a more frequent basis – offers more timely and relevant data for decision-makers in the financial markets.

Cash may not be the most effective way to motivate employees

Tangible rewards motivate employees when they’re easy to use, pleasurable, unexpected, and distinct from salary, a new study found.

A recent survey of firms in the United States revealed that 84 per cent spent more than $90 billion annually on tangible employee rewards, such as gift cards, recreation trips and merchandise, in hopes of increasing productivity.

Motivating Employees with Goal-Based Prosocial Rewards

A recent trend in organizations is to motivate employees with goal-based prosocial rewards, whereby employees must donate their rewards to charities upon goal attainment. We examine the motivational effects of goal-based prosocial rewards versus cash rewards under different levels of goal difficulty. We develop our hypotheses based on affective valuation theory, which posits that when valuing uncertain outcomes by affect rather than calculation, individuals are largely insensitive to changes in probability of the outcomes, including probability of goal attainment.

Director Appointments - It is who you know

Using 9,801 director appointments during 2003-2014, we document the dramatic impact of connections - 69% of new directors have professional ties to incumbent boards, a group representing 13% of all potential candidates.

Does the tax deductibility of interest affect financial reporting and investments?

Many countries have imposed tax policies that limit the deductibility of interest costs, creating a plausibly exogenous increase in the net cost of borrowing. The limits are based on financial accounting numbers, adding a new implication to managers’ choices. Firms in these countries are also expected to rely less on debt financing and face weaker demand for conservative financial reporting from creditors as compared to firms in other countries.

I Know Something You Don't Know:

The Effect of Relative Performance Information and Individual Performance Incentives on Knowledge Sharing

COVID-19 has negatively impacted how auditors work

COVID-19 has disrupted financial statement auditing globally and impacted group dynamics in an industry vital to the health of the economy, according to a new study.

Needs vs Wants: Which Motivates More Effort? Adam Presslee

A significant and increasing number of North American organizations use tangible rewards to motivate their employees. Despite the widespread use of tangible rewards, there is limited understanding as to what makes them effective.

The False Promise of ESG

Millions of investors and countless fund managers direct their investments to companies that are highly-rated on the basis of their environmental, social, and governance (“ESG”) activities in an attempt to do good. The claim by ESG advocates, pundits, and many academics that highly-rated ESG companies and funds also deliver superior returns bolsters this move: Doing better by doing good. The best of all worlds.

But do ESG ratings really deliver on the promise? Are highly-ranked ESG businesses really more caring of the environment, more selective of the societies in which they operate, and more focused on countries with good corporate governance? In short, is ESG really good? The answer is no.

Celebrating alumni achievements on International Women’s Day

The theme for this year’s International Women’s Day is #BreakTheBias, calling people to imagine a gender-equal world free of stereotypes, bias and discrimination. This is also a day to recognize and celebrate the social, economic, cultural and political achievements of women.

Corporate taxes can be good for shareholders

Corporate taxes can be good for shareholders: Why some actually want their companies to pay tax

How cryptocurrency and government relief packages could impact your tax returns

How cryptocurrency and government relief packages could impact your tax returns