COVID-19 and climate change set to impact the insurance industry significantly

The

repercussions

of

COVID-19

and

worsening

climate

change

are

among

the

issues

that

will

impact

the

insurance

industry,

according

to

Tony

Wirjanto,

University

of

Waterloo

professor.

Wirjanto,

working

as

a

curator

in

Insurance

and

Asset

Management

for

the

World

Economic

Forum

(WEF),

identified

eight

key

issues

poised

to

influence

the

insurance

industry

in

the

recently

released WEF

Transformation

Maps.

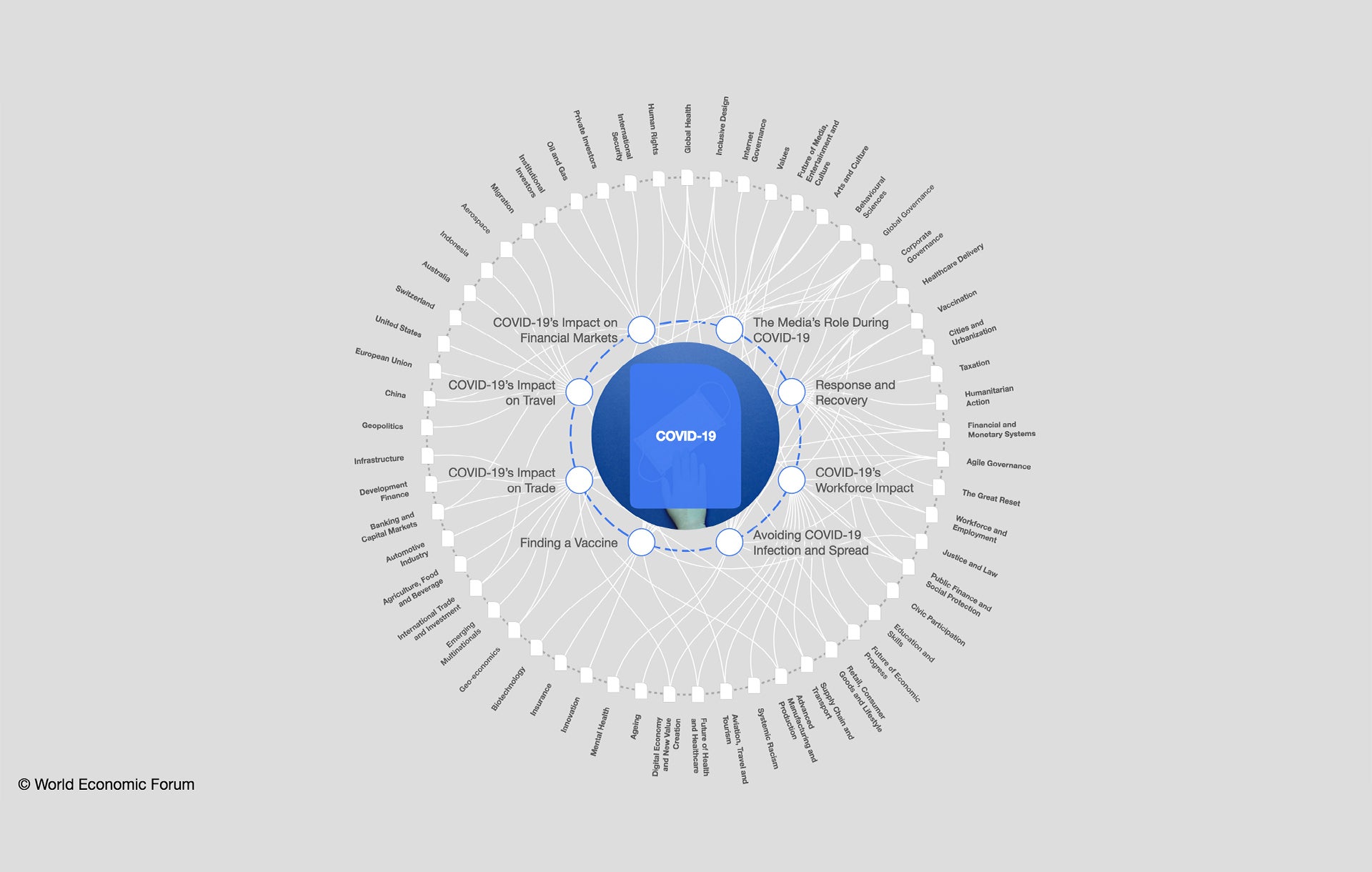

Transformation

maps

are

dynamic

knowledge

tools

that

help

users

explore

and

make

sense

of

complex

forces

transforming

industries.

It

allows

leaders

in

that

space

to

visualize

and

understand

more

than

250

topics

and

their

connections

between

each

in

one

place.

The

result

helps

support

better-informed

decision-making.

The

eight

issues

explored

in

the

insurance

transformation

map,

in

this

case

specifically,

are

big

data,

commoditization,

privacy

trends,

cyber

risk,

artificial

intelligence,

insurtech,

Internet

of

Things

and

climate

change.

COVID-19

will

be

the

latest

topic

to

be

added.

According to the insurance transformation map, climate change is a systemic and irreversible process that introduces sensitive paradigm shifts to insurers’ risk-return profiles — significantly affecting both the asset and liability sides of their balance sheets. Climate change risk affects both the “property & casualty and life” insurance sectors in several important ways. These, in turn, pose a threat to the reinsurance industry through coverage of exposures that are in excess of insurers’ capacities.

Wirjanto believes the insurance industry may, in the end, be able to survive the COVID-19 pandemic as it has done in other notable crisis episodes in the past. However, to do so, insurers need to quickly determine how best to meet the needs of their employees, brokers and customers with products, financing, sales and service that work best in the presence of the unprecedented scale of this pandemic crisis.

“This

project

started

before

the

pandemic,

and

this

is

why

I

haven’t

included

the

impact

of

COVID-19

in

the

initial

insurance

transformation

map,”

Wirjanto,

a

professor

jointly

appointed

in

Waterloo’s

School

of

Accounting

and

Finance

and

Department

of

Statistics

and

Actuarial

Science,

explains.

“My

job

is

to

update

these

key

issues

every

three

to

four

months

over

the

next

five-and-a-half

years,

and

I

will

include

the

impact

of

COVID-19

for

each

of

the

eight

key

issues

in

the

next

edition.”

The

maps

are

driven

by

an

AI

algorithm

that

anticipates

what

type

of

information

policymakers

and

public

officials

may

need.

The

curator

then

collects

relevant

and

actionable

information

and

makes

it

available

in

one

linkable

source

to

aid

the

decision-making

process.

In

coming

up

with

the

map’s

content,

Wirjanto

and

his

team,

former

PhD

student

Mingyu

Fang

(’19

ActSc)

and

Rong

Brenda

Dang,

a

current

master’s

student

in

the

Computational

Mathematics

program,

undertook

a

tremendous

amount

of

research

to

ascertain

the

challenges

CEOs

working

in

the

insurance

industry

face.

Based

on

research,

Wirjanto

believes

worsening

climate

change

and

the

global

responses

to

the

COVID-19

pandemic

so

far

have

highlighted

the

need

for

insurers

to

adopt

various

innovative

approaches.

These

methods

include

customer-centric

digital

tools

and

other

innovations

that

respond

to

stakeholders’

needs

in

times

of

a

crisis,

such

as

online

payment

of

premiums

and

claims

and

acceleration

of

digitization

adoption

to

improve

data

collection,

products

and

customer

relations.

“It

has

become

increasingly

clear

that

insurers

need

to

tailor

their

products

and

processes

to

accommodate

differing

risk

profiles

as

well

as

differing

needs

of

their

diverse

customers

and

work

to

mitigate

the

extent

to

which

this

pandemic

crisis

further

widens

the

existing

gender

gap,

income

gap,

etc.,”

Wirjanto

says.

“Whereas

the

climate

change-related

impacts

merit

greater

amounts

of

risk-related

research

in

the

insurance

industry.

“Integrated

assessment

models,

which

can

aggressively

leverage

cross-disciplinary

tools

from

climate

science,

finance

and

actuarial

science,

should

increasingly

be

used

for

robust

quantitative

analyses

of

risk

and

effective

qualitative

studies

on

the

subject

will

also

be

valuable.”

Interested to hear how green innovation is driving our economic recovery? Register for our next Waterloo Innovation Summit scheduled for November 30, where industry leaders will explore how green innovation and sustainable enterprises can drive economic growth while ensuring our planet’s future.